Mind the Gap!

12/12/2014

It is earth shatteringly obvious to repeat once more that the hospitality sector was hit extremely hard by the downturn in the economy with consumers choosing to go out less and when they did, spend less.

We also have real proof that it was not just the economic pressure which has affected our trade, general consumer habits have shifted in the last 10 years with beer volumes in decline and a shift towards foods, wines and of course coffee. Despite all of these pressures, in the future it is a distinct possibility we will regard 2014 as the year the sector fully recovered.

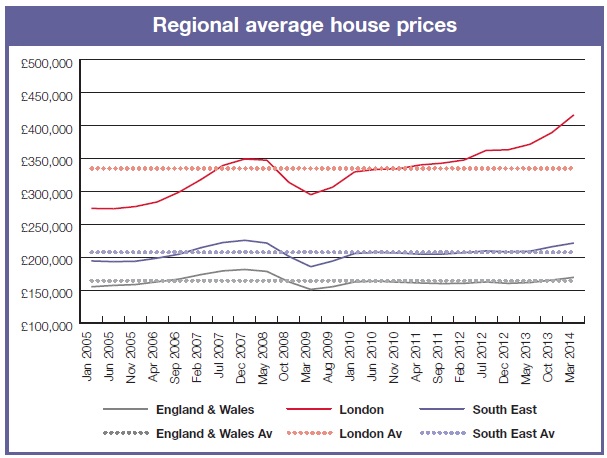

It is important we consider the macroeconomic factors prevailing over the last 12 months. The economy has seen four consecutive quarters of GDP growth, the continuation of record low interest rates, falling national and youth unemployment, together with inflation being under control. The housing market is also seeing signs of recovery nationally set against fears of a bubble in London and the surrounding areas.

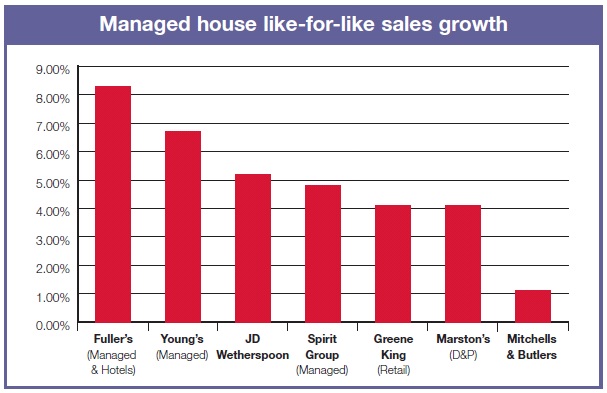

Whilst it is dangerous to draw direct comparison between the housing market and the pub sector, a "two speed market" has appeared in both markets over the last 12 - 24 months. This can be seen in trading results and asset values. Set out below are the reported like-for-like sales which highlight the strength of the London centric estates verses those with a more national footprint.

"2013 felt like a new dawn for ETM. Like for likes were 4.9% for the year. Strong results but that doesn't reflect the true picture. After several flat years following the crisis of 2008/9 confidence was back and you could feel it in the air.

2014 has seen us build on that success with like for likes of 6.1% for the first six months. A fully integrated training regime and further development of our marketing and events team has driven this success. Pre-booked events continue to grow. For example The Chiswell Street Dining Rooms, a 5 day a week operation is now fully booked on Saturdays with weddings until the end of the year" Tom Martin | Co-founder ETM Group

Interestingly M&B report that 45% of the income is now derived from the London (23%), South East (15%) and East (7%) regions. London is becoming an increasingly important battle ground for the operators.

"We are receiving a growing number of propositions from both new and existing customers across the leisure sector, and it is clear that activity in the industry is picking up pace and gathering momentum. Trading results and asset values are improving in key Central London and South East markets, and providing that firms have a good track record and a sound financial history, they are in a strong position to secure additional funding from their banking partners" Avril Carol | Relationship Director, Lloyds Bank Commercial Banking

Source: Land Register

Source: Reports, Accounts and Interim Statements

When discussing asset values throughout Fleurets national network of offices, anecdotal evidence points to a clear London weighting. It is extremely difficult to compare apples-with-apples in asset terms, the point is illustrated by the competitive bidding and eventual sale to Fullers of the Harp, Covent Garden for in excess of £7m, which we understand reflects a multiple exceeding 14.00 Y.P. for an established 'wet-led' business, by comparison we are aware of a number of transactions in the Midlands and the North of England involving high quality food houses, with all the managed house property fundamentals in place and proven trading history transacting between 7.50 Y.P and 8.50 Y.P.

"We at Santander Corporate and Commercial Banking have noticed an increase in enquiries from hotel, pub, bar and restaurant customers over the last 12-18 months. We are strong supporters of these sectors. The low interest rate environment, an increase in the competitiveness of the lending market and improving trading conditions appear to be fuelling operators desire to expand their estates through new acquisitions or develop their estates through refurbishment and capital expenditure programs. It is an exciting time for the sector and we are well positioned to assist operators realise their ambitions" Michael Young | Relationship Director, Hospitality & Leisure, Santander Corporate & Commercial Banking

One could again conclude patrons in London and the South East have enjoyed the benefit of lower mortgage repayments, predicated on an increase in equity within their homes and continued employment allowing improvements in discretionary spend and general consumer confidence. Client feedback from the coal face of the drinking and dining market in Central London is that corporate cards are making a welcome comeback.

In addition to one off acquisitions, the mergers and acquisitions market is back in full swing with M&B's recent acquisition of 158 sites from Orchid. This year we have also seen the creation of Hawthorn Leisure as a result of the acquisition of 275 pubs from Greene King and M & P Partner's buyout of Amber Taverns which consists of nearly 100 pubs across the North of England.

"Encouragingly I am seeing increasing volumes of enquires from SME businesses to expand their estates, together with existing clients and proven operators re-entering the market seeking to capitalise on strong trading conditions and low cost of funds. Furthermore there have been a number of successful fundraisings via EIS and VCT schemes, which demonstrate strong investor appetite. My customers are finding competition for new sites extremely challenging and therefore we are seeing more leasehold opportunities as those clients seek to stretch their capital into less intensive assets that can generate cash immediately. We continue to be supportive of the right operators" Steve Crosswell | Relationship Director, Natwest Bank PLC

This M&A activity illustrates that financial institutions are prepared again to fund large scale acquisitions. At a more localised level, the major banks have all signalled their commitment to the sector and in particular the London market, which will fuel the embryonic pub co's and the independent market.

The aforementioned factors has resulted in competition for Central London assets at their highest level in recent memory, operators are starting to move outside of London to secure sites at a reasonable level where the traditional risk/reward rate of returns are available. A good example of this activity is established cocktail bar operator, Be At One seeking to capitalise upon their success in the London market by expanding into regional towns and cities and the City Pub Company's acquisition of Georgie's House, Norwich and the Lion and Lobster, Brighton and Loungers continuing expansion.

"The outlook amongst our clients is becoming increasingly positive and we are seeing more robust trading performances across our existing customer base, particularly in Central London. The market is strengthening and operators are looking to capitalise on every opportunity, either through refurbishment, improvements to their operational offering or through new acquisitions, and Barclays is keen, and has the expertise, to support this activity" Matt Walton | Relationship Director, Barclays Bank PLC

Looking ahead to 2015, and applying a fairly major caveat that the Chancellor will let the 'air out of the tyres' gently with respect to the prevailing low interest rate culture, trading levels should continue to increase, particularly food sales as the boundaries between pubs and restaurants continues to merge. In addition with operators seeking to maximise returns, the growing trend to open earlier and offer breakfast will continue with Wetherspoon having been at the vanguard of this change.

Lastly, with improved trading conditions and funding at an all time low for the major pub companies, it is likely a continuation of their aggressive acquisition of freehold managed house assets from independent operators, and new build program will continue at pace.

Only history will prove exactly where 2014 ended up in the general cycle. However, assuming the current social, fiscal and general economic trends continue, if the hospitality sector were a hospital patient, I think we can cautiously confirm it has returned to fitness but requires ongoing therapy in some areas.