Pubs sold for alternative uses in 2013 by Fleurets

31/03/2014

As a market leader in the sale of freehold pubs we have undertaken analysis of how many we sold for continued pub use and how many were converted for alternative use in 2013. We further analyse what uses they were converted to.

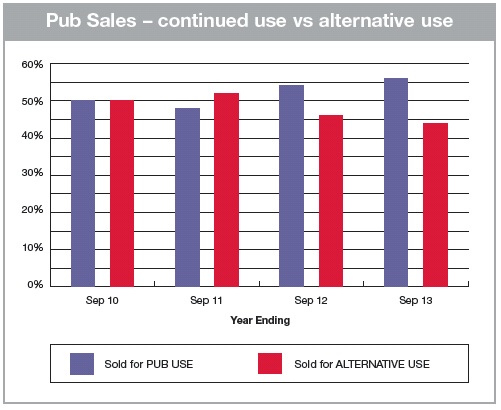

The number of ALL freehold pubs sold by Fleurets last year for continued pub use, increased for the second year running to 56%. However, the percentage of 'bottom end' pubs sold in the year that stayed as pubs reduced to 50% down from 52%.These figures suggest that it is the lower quality pubs that are more often being sold for other uses.

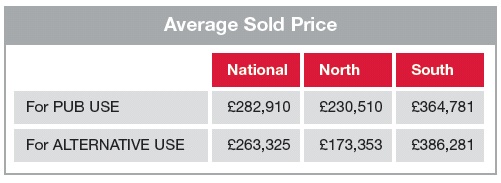

The average sale price of freehold pubs sold by Fleurets nationally last year, was £282,000 which was 7% higher than for alternative use. However in the south sales for pub use was £365,000, which was 6% lower than for alternative use. In the north sales for pub use was £230,000 which was 33% higher than sales for alternative use.

This suggests that in the north more pubs are closing and selling for alternative use because they are no longer viable as pubs, but in the south there are more pub sales going for alternative use because of the higher values being generated. At only +6% higher, however, it is not a significant amount and it may well be attributable to a few very high value alternative use sales in central London.

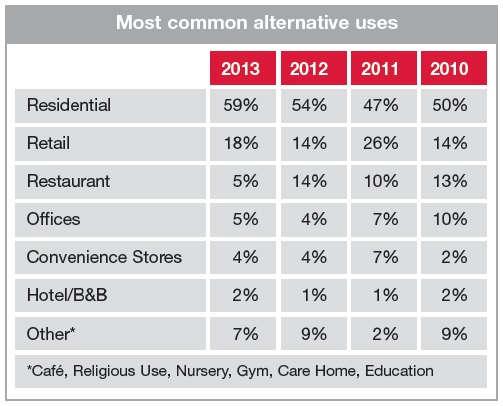

We have continued to see a slow down in the conversion of public houses sold for alternative use, but the most common end uses haven't changed a great deal over the last four years. What can be seen from the end use figures is that there has been a continued increase in the percentage being sold for residential conversion/development which last year accounted for 59% of all alternative use sales. The other point of note is that the supply of pubs to convert to CV stores is continuing, and we have seen developers continuing to identify suitable sites with many working directly with the big pub companies.

Click here to open the pdf directly.