Survey of Pub Prices and Alternative Use - 2015

30/12/2015

Click here to view the complete PDF

2015 will be seen as the point where the economic recovery started to reach the pub property market in all regions of England and Wales. The effect is, however, not consistent for all locations, tenures or styles of operation. From continued strong growth of rents and capital values in central London to the early stages of increased deal activity in many northern towns, the market is clearly moving.

Merger and acquisition activity is very firmly back on the agenda with several tenanted and managed package deals completed in the last 12 months. With an abundance of private equity funds eager to invest in our asset backed, high cash flow sector, a lot more is sure to follow. Pending legislation may slow short-term activity but whichever way the Market Rent Option (MRO) falls, deals are likely to follow.

Market Overview

- Average freehold sale price up 5.5%

- -22% decrease in freehold sales volume

- 46% increase in volume of leasehold deals

- Twice as many leasehold deals in the south

- Increase in free of tie assignments

It is difficult to generalise about the Pub market due to its diverse range of operational styles, tenures, occupational arrangements and locations, but few would argue that 2015 has seen a strengthening of market conditions.

The underlying economic recovery and growing consumer confidence have stimulated sales growth. This improved trade performance has led to a change in market dynamics, from being dominated by discount deals and bargain hunters, to one where the owners are now holding more of the cards and the buyers are fighting for the best of what's around.

This is no better demonstrated than in the community based public house market, where the big tenanted pub company operators have all but stopped the individual sale of assets. Instead they have seen the benefits of selling them in groups. Initially some group deals reflected a discount to aggregate values but more recently lotting premiums have been achieved.

Managed house operators continue to grow market share, either by new build (Marstons), individual acquisitions (JDW, Amber Taverns, etc), or by group deals (Greene King with

Spirit and Stonegate with TCG). Much of the focus is on managed food led operations as

this is a market in growth.

Increasing prices in London are leading to many operators seeking better returns on

their investments in regional centres. This is evident in cities such as Birmingham, Bristol

and Leeds. In some of these regional cities, high levels of city centre activity is also

starting to tempt some operators to consider the secondary regional towns.

The freehouse market, after several years of stagnation, is once again coming to life with

sellers choosing to place their businesses on the market (as opposed to being forced to),

encouraged by increased buyer confidence and growing demand.

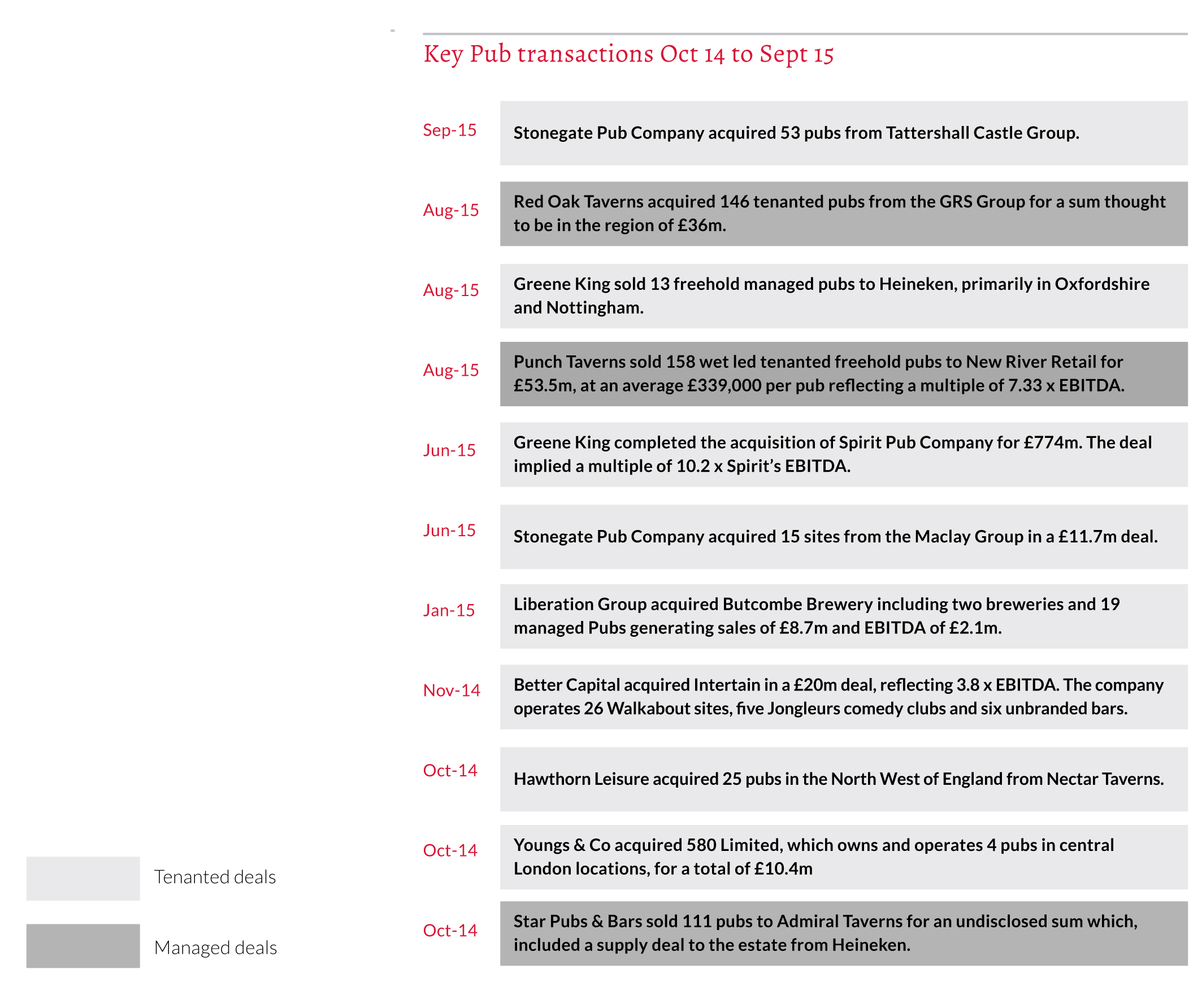

Package Transactions (M & A activity)

The number of significant corporate deals that took place last year was similar to the

number in the previous year.

What is different, however, is the scale and purpose of the transactions, with almost

twice the number of properties transacted and at nearly twice the total price.

Below is a summary of the most significant group transactions in the 12 months to

September 2015 which total almost £1bn and involve 1770 pubs.

Key Pub transactions Oct 14 to Sept 15

Overview - Bottom End Freeholds

The economy is strengthening, confidence is returning and trading performance is increasing. This has lead to an increased demand which, along with reduced supply, has increased pub values in virtually all areas.

One of the biggest factors affecting the pub market has been the continued reduction in

the supply of bottom end freehold pubs. We reported last year that volumes had fallen

-25% and this has been repeated in 2015 with a -23% decline reported in this category.

This was most acute in the south, which was down -38% in volume, compared to the north

which was down -12%.

The quality of properties transacted varied greatly. On the one hand it was a case of

selling off the worst of what was left, i.e. lower quality properties that had not been

sold before, often from Administration or from the end of Pub Co. disposal

programmes involving some of the problem sites that had been on the market several

years. On the other hand, better quality properties have been coming to the market

selling for higher prices where conditions were warming. Current statistics do not,

however, reflect this change as there is a time lag between properties coming to the market

and being sold.

Many Pub Co. operators retained sites which had clear development potential, often seeking to carry out developments themselves or in joint ventures to extract greater value.

Sales for alternative use continued to be an important factor at this end of the market, although there has been a narrowing of the price differential; the average sale price for continued pub use being 2% higher than the average sale price for alternative use. 8 out of our 10 highest value sales of bottom end pubs were for continued pub use.

The year ahead

The mass disposal of bottom end tenanted pubs has now ended. Sales going forward will reflect commercial estate management decisions involving the practice of "churning" under performing properties to enable reinvestment, as opposed to pressure for debt repayment.

Sites will be identified for development and these individual opportunities, offering higher value for development, will be sold individually.

The average sale price of individual bottom end pubs is likely to increase, driven by the growth in residential values, reinforced by reduced supply. We anticipate that the number of properties being sold for alternative use will decline as the viability and quality of operations improves.

We anticipate that the increase in merger & acquisition activity we saw last year will continue, possibly accelerated following the MRO legislation. Strategic decisions to buy and sell groups will continue in the year ahead. The holding companies will consolidate their estates and might be increasingly tempted by stronger buyer demand and values.

Buyers will seek to exploit the benefits that a pub estate can offer, for asset backed cash

flow and enhancement of value.

Overview - Freehouses

The improving economic fortunes experienced in most parts of the UK has seen an increase in pub values in almost all areas despite the challenges of raising finance and political uncertainty.

The south saw a reduction in the volume of high value London sales transacted, with numbers down by more than 50%. This was driven by the Pub Co's reduced need to sell prize assets to repay debt, and owners seeing greater opportunity for increased returns by holding onto assets in a rising market.

The southern regions, excluding London, saw an increase in average sale price of 3% despite a reduction in the average Fair Maintainable Trade (FMT) assessment of -1.6%. This was due to an increase in the average multiple of FMT by 4.5% and would have been higher but for an increased proportion of sales in some lower value areas. The south sold twice as many freehold freehouses as the north.

Private owners of operational and viable pub businesses are increasingly testing the market as demand levels are increasing, with encouraging results. The second half of the year saw 35% more sales concluded across all regions compared to the first half of the year.

The year ahead

We expect the increased volume of freehouse transactions to continue in 2016. With confidence returning in most areas and trading fortunes improving, demand is increasing. Alongside the reduced supply of bottom end freehold pubs, we will see an increase in sale prices. Year end figures will, however, continue to be influenced by the sales mix and wider economic conditions.

Overview - Leaseholds

The most significant feature of our statistics on leasehold pub transactions, is that the volume of deals increased significantly, up 46% on last year, reflected evenly in the north and the south. The increase in the volume of assignments and particularly free of tie leasehold transactions has provided greater diversification of the market and wider choice for operators of all varieties.

The growth of free of tie lettings and assignments is partly a result of the huge number of freehold Pub Co. sales over the last 7 years, swelling the privately owned freehouse market. Purchasers of those freeholds who bought to let are now seeing the leases being assigned. Some purchasers who bought to occupy are now seeking to lease out their pubs, rather than sell or continue operating themselves. This is increasing the free of tie opportunities in the market.

The average sale price is down -5% nationally, mainly as a result of the lower quality and geographical spread of deals, compared to the previous year. The average sale price in the north was up 27% due to a number of high value deals in the midlands and the average sale price was down -13% in the south, largely as a result of a higher proportion of lower value letting transactions in the West Country.

Sale prices have ranged from "nil premium" with incentives, to £700,000, with the highest number of 6 figure premiums not surprisingly being achieved in London, accounting for 42% of leasehold transactions.

Average sale price as a multiple of FMT remained broadly the same as last year at

0.13, being split, 0.10 in the north and 0.14 in the south, however, the average FMT was

£385,000 up 2.4%.

The year ahead

The increased activity experienced in the last 12 months has been particularly encouraging, but with MRO legislation on the horizon it is difficult to predict what is likely to happen to the leasehold pub market.

We are likely to see an increase in free of tie deals in the medium term, but in the short

term an increase in new lettings on tenancy agreements and little change in the number

of leasehold assignments, is most likely, as the uncertainty over legislation dampens

activity.

The proposed Market Rent Option legislation, to entitle tied Tenants to a free of tie rent review, is still far from certain.

Whatever is finally documented will have implications for the industry that are largely unknown. What is evident is that the continued uncertainty is delaying longer term planning and investment and many companies have reduced the number of new lease deals being granted.

The pending legislation has, however, resulted in a wide variety of initiatives in a bid to reduce the potential impact of what might be imposed. These includes stronger buying clubs, new operational / occupational agreements and in some cases new managed house divisions. If this continues we are likely to see a decline in the number of leasehold transactions in the medium term as fewer assignable leases will be granted and thus, fewer available to assign.

The future is uncertain and change is almost inevitable, however, this typically leads to innovation and evolution. We are certainly entering an interesting and exciting time for

the sector.

Our Analysis is divided into 3 categories:

Bottom End Freeholds

These are properties generally sold without accounts, sometimes closed or vandalised

or, if operational, under temporary tenancy/ management arrangement. These are

primarily pub company sales but also include administration sales and occasional private

sales. Invariably they reflect some form of forced sale situation.

Freehold Freehouses

These are generally better quality pubs sold with the benefit of accounts with an unrestricted marketing period. They are operational and typically viable businesses, usually sold by private individuals, but also by managed house operators and not in a distressed situation.

Leaseholds

This group covers a wide spectrum of properties including high street bars, community locals and destination food houses. The transactions include free of tie and tied deals, on assignment, letting and underletting. Some deals reflect a negative value due to reverse premiums being paid or sub lettings at a lower rent than the passing rent.

PUB SALES - Alternative Use

The continued reduction in the total number of pubs is a concern to all those who

love this very British institution. As a national treasure, viable pubs must clearly be

protected. However, with rapidly changing economic, demographic and social habits

the current supply of public houses is not meeting the requirements of the population.

This is why, in the vast majority of cases, pubs close and get sold for alternative uses.

In this review we have analysed all freehold pub sales transacted by Fleurets in the year

to September 2015 to see what pubs are being used for after they are sold and what

variations in the sale price there may have been, between continued pub use and

change of use.

Intended uses

In keeping with the average number of pubs sold for continued pub use over the last 6 years or so, last year saw 50% of freehold pubs sold by Fleurets remaining as pubs. Whilst this is down from 56% the year before, it is very much in line with the trend since the early days of the recession, which averages 52% for pub use over the last 6 years.

Despite the boom in property, and particularly in residential values in the south, the percentage of pubs sold for continued pub use in the south was 55% compared with

the north which was 47%.

The average sale price nationally for pub use was virtually identical to the average sale

price for alternative use, being just -1.1% lower for pub use. There was, however, a significant regional variation with sale prices for continued pub use being 6.7% higher than alternative use in the south, whereas in the north pub sale prices were -12.4% lower than alternative use sale prices.

Most common uses

Residential conversion or residential development has been by far the most common alternative over the last 6 years. Whilst the proportion of residential end uses has reduced slightly, it still accounts for well over half of the alternative end uses of pubs that were sold.

The percentage of sales for convenience stores (CV stores) declined last year, however, this is mainly a reflection of many of the Pub Co's seeking to develop sites themselves in direct partnership with CV store operators rather than openly marketing them on an individual basis.

The increase in the number of pubs sold for conversion to coffee shops is an interesting

development, particularly as some multiple pub operators are starting to move into this

market with combined licensed bar/coffee shop operations, promoting coffee in pubs

and bars much more, or even developing their own brand of coffee shops. This

diversification is likely to continue.

Other end uses have varied widely including children's swimming pool, a vets

and a museum.

Assets of community value (ACV's)

The protection of viable public houses continues to be a high profile, political and social issue. The balance between allowing market forces to be heard in an era of changing social and economic climate and saving community facilities for future generations has never been easy. Ever since the first pub to be bought by a community, (the Red Lion in Preston, Hertfordshire, in 1980) this has been a battle ground between the owners and the communities their pubs service.

The Localism Act 2011 brought the matter into much sharper focus, giving the ability for Community Interest Groups to apply to have their local Pub listed as an Asset of Community Value (ACV). Since then, with the heavy support of CAMRA, there are now reported to be 1200 pubs listed as ACV's. This is double the number reported last year.

The number of Community Groups who have successfully completed a purchase of their local is vague, however, the number is thought to be around 50. The number of pubs that have come to the market with ACV status is considerably higher.

So, is the legislation having the desired effect or are the disadvantages starting to mount up?

Here we take a closer look at the pubs Fleurets sold last year which were subject to ACV listings. We consider what effect the listing had on the sale and the ultimate outcome of the sale.

In 2015 Fleurets sold 10 pubs that were subject to ACV listing. This was marginally down on the previous year where there were 11 and in 2013 only 3.

The outcome of the 10 sales

- 1/10 Bought by a Community Group

- 2/10 ACV listings saved the Pub

- 0/10 ACV listings caused the loss of the pub that could otherwise have sold for Pub us-

- 4/10 Sold for alternative use

- 7/10 Sales were delayed as a result of the listing

- 3/10 Considered to have sold for a range £25-80,000

Drawing any detailed conclusions from such a small sample is di fficult, however, the results are very similar to last year. 40% of pubs listed as ACV's were sold for non-pub use compared to the national average of freehold pub sales over the last 6 years, where 48% were sold for

non-pub use.

Only one Pub was purchased by the Community, the Royal Oak at Rushton Spencer near Macclesfield, but two Pubs were effectively saved by the ACV listing (the other being retained and let instead of being sold)

The majority of sales (70%) were delayed as a result of the ACV listing. In one case this was over a 16 month delay, and 30% had a clear indication that a lower price was achieved compared to what could have been achieved with an unfettered sale. Two of these cases

were sold for alternative use and one was for Pub use.

Whilst some Pubs can clearly be prevented from being converted as a result of ACV legislation, it is clearly at a cost. This is not only as a result of some vendors having to sell for a lower price but also an associated cost incurred as a result of the delay in the sale. This can

often run into tens of thousands of pounds in additional business rates, insurance and security charges, let alone additional legal fees involved in dealing with the ACV listing.

This might be considered by many to be a cost worth paying, but to date, little action has been taken by the affected Vendors to recover costs and seek compensation for the losses incurred. However, to date the vast majority of sales have been conducted by the Big Tenanted Pubs Co's. In 2013/14 100% of our ACV sales were from the big Pub Co's, last year 70% were from Pub Co's, 20% from Administration and 10% private vendors.

Challenges to ACV listing applications are growing stronger and some affected owners are understood to be considering claims for compensation. If successful, rate payers will undoubtedly pick up the costs one way or another.

As the number of ACV listings continues to increase more private owners are likely to be caught up in the process rather than the faceless Pub Co. If more of the affected Vendors also seek compensation impacting on available tax revenue, it will be interesting to see if the "cost" associated with ACV listings continues to be considered a price worth paying.