Rental Survey 2017

23/10/2017

Click here to download the complete PDF

2017 marks the 32nd edition of Fleurets' Annual Rental Survey. The survey covers information available to Fleurets relating to deals undertaken over the past 6 years, covering the licensed and leisure market, including pubs, bars and restaurants. In particular we have concentrated on rental information relating to free of tie pubs and shell lettings.

Market Background

The biggest single issue to have impacted on the market over the past 12 months has been the Brexit vote for the UK to leave the European community. This surprising result has had further repercussions with a snap General Election resulting in a hung parliament. These events have created a degree of market uncertainty and most notably have impacted on the value of the pound. Against this we still have relatively low inflation, but this is now starting to creep up; partly on the back of high levels of consumer spending. It is also being driven by cheap and readily accessible debt (shades of the market from 2005 to 2007, prior to the last recession) and we have record employment levels. There are however signs that the economy is stalling and emerging signs that the London market is reaching a tipping point. Consumer spending is reported to be slowing.

We have seen an increase in terrorist activity not just in Europe, but in cities in the UK,including major urban areas such as London and Manchester. Whilst most people will continueto go about their daily activities unaffected, these events will inevitably have an impact on visitor numbers and tourism, albeit the latter is being underpinned by a weak pound. We can only hope that Brexit negotiations are concluded sooner rather than later; although at the time of writing this report there is no evidence that an amicable solution is close.

Within the leisure sector, managed house companies continue to be the main focus of business activity with companies such as Greene King, Marston's, J D Wetherspoons and Mitchells & Butlers, all posting positive results despite the increase in the National Living Wage and the new Rating List. The latter has hit operators, particularly in the more affluent South East and London areas, as well as prime spots in regional city centres. It is likely to take at least another 12 months before any rating appeals are dealt with by HMRC and this maybe too long for some businesses to survive. These two issues will affect trading profitability, which ultimately will impact on rental values.

White House - Guildford

Pub Sector

It is now over 12 months since the Pubs Code came into effect. There have been mixed reviews over its success. The Code had two main themes; one was to give more protection to tied pub tenants and the other was to provide an option for tied tenants to seek a Market Rent Option (MRO), thus allowing them to go free of tie.

Arguably there have been fewer than expected applications for MRO, certainly fewer than the campaigners might have expected. A number of MRO requests have been dealt with by independent adjudicators, however, we are aware a number of these decisions have been appealed and are awaiting determination by Pubs Code Adjudicator.

One aspect that has come out of 12 months dealing with the Pubs Code is the wide spread concerns over its drafting and the complicated framework that it has put in place. Given the disjointed nature of the Code, this has meant that tenants have had to employ external parties including accountants, lawyers and surveyors, which have driven up costs. Not surprisingly commentators are requesting that the Pubs Code be redrafted to make it more "user friendly".The lack of take-up may also reflect the perceived benefit that there is still within the tied lease, particularly given the business support that may not be available if a tenant goes free of tie. We believe in a number of instances tenants are using the threat of MRO to negotiate more favourable tied lease terms.

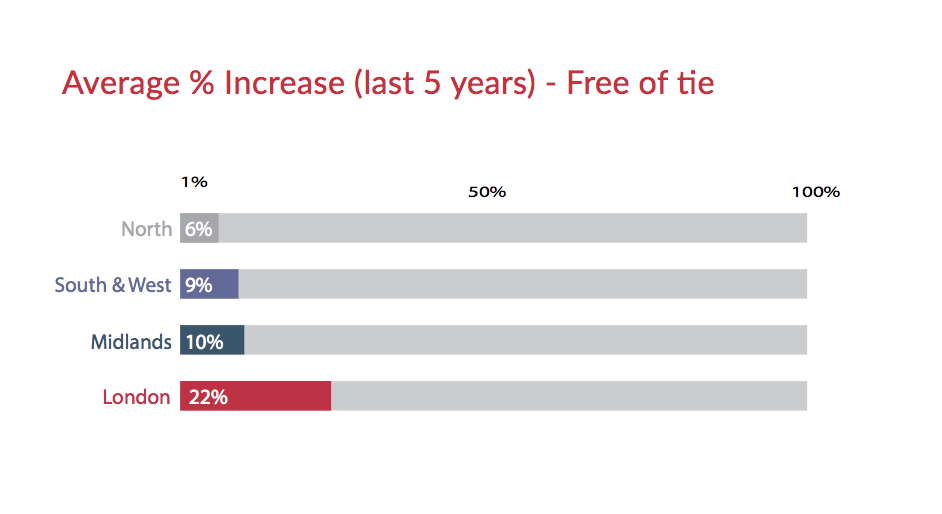

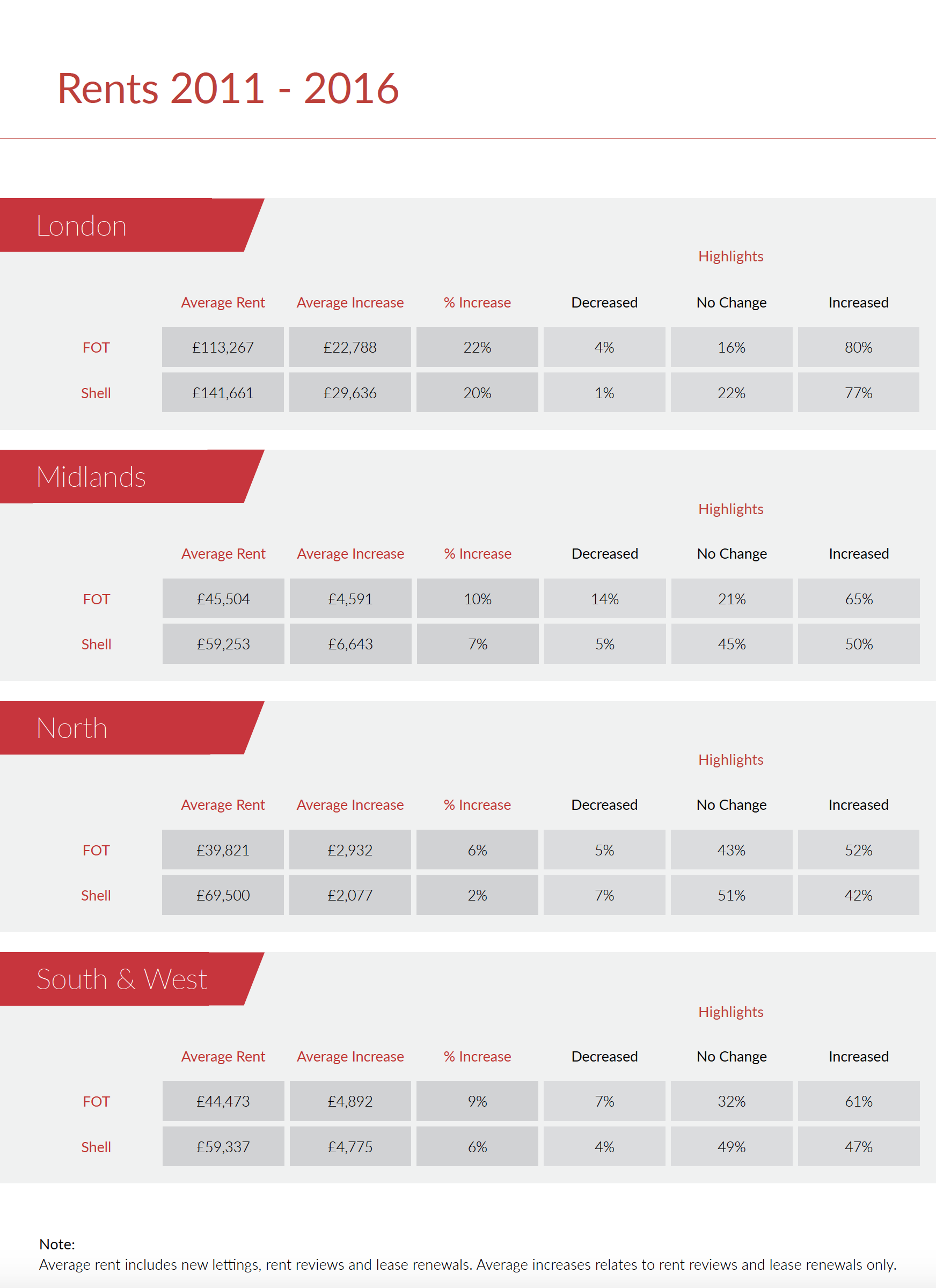

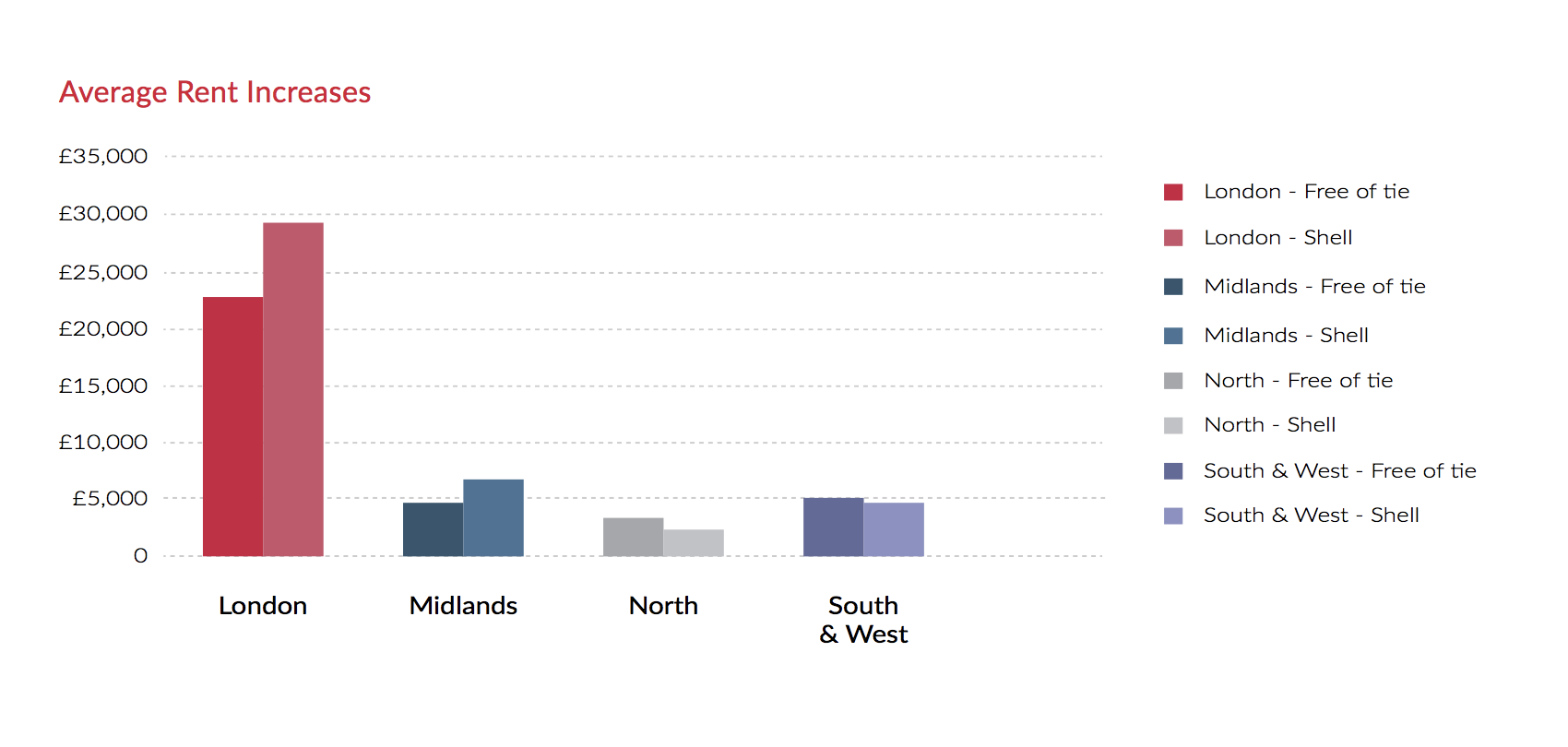

In respect of rental levels it has been seen, not surprisingly, that London has the highest rents in the county. Also from Fleurets' perspective London has seen the largest level of rent reviewactivity. As can be seen from our statistics, London rents have had the biggest increase in numbers of reviews, where 80% of those actioned have resulted in a rent increase. This compares with the regions where between 52- 65% have resulted in an increase.

Overall rents in London, on free of tie terms, increased by 22%, with an average increase of£22,788. Regionally numbers were significantly lower, with the average increase between 6-10% over the 5 year period, equating to only £2,932 to £4,892.

Three Fishes - Ribble Valley

Shell Rents

This sector incorporates both bars and restaurants. With the blurring of boundaries between what is a bar, a gastro pub and a restaurant, there has also been a blurring of what evidence can be used in conducting rent reviews. Many older leases allow both bars and restaurants within the user clause, particularly those that refer to the older use class order. It would be normal to expect a restaurateur to be able pay more for their optimum sized unit, as their fit out costs will be lower than would be the case for a bar.

The trend for London based operators expanding into the regions has continued; but many are paying inflated rents because of their perception of regional rents being cheap relative to London. We have seen significant landlords incentives being granted, including large reverse premiums to assist with fit out, extended rent free periods. Sometimes this is done to make a deal happen and sometimes to drive up headline rents. Any surveyor dealing with rent reviews needs ensure they are fully conversant with all parts of the deal, not just the headline figures.

Bridge Inn - Port Sunlight

Within the regional market we see a number of hotspots, including regional cities such as Bath and Manchester, amongst others. We are also seeing hotspots within the city centres whererents have grown and new circuits evolved. Despite this, however, there are areas within cities where secondary locations will be seeing no rental growth.

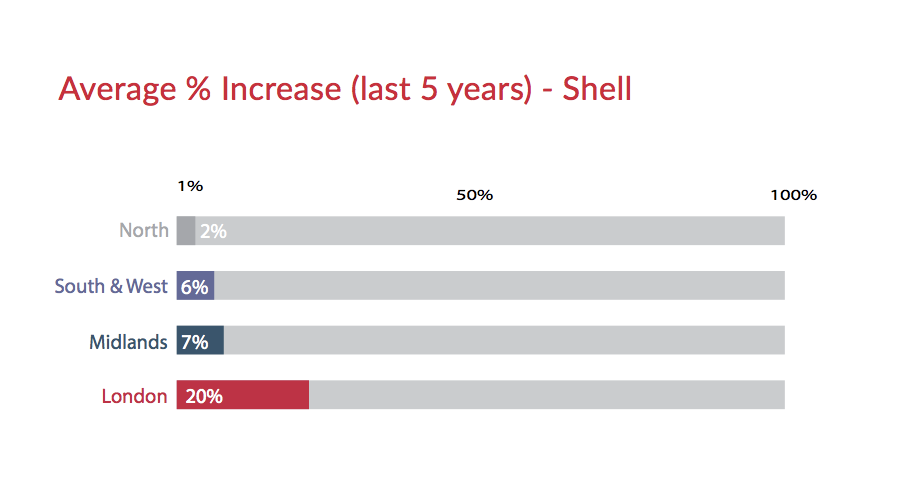

London continues to dominate with average rents of £141,661. There has been a 20% increase in rents at review where over 77% of rent reviews actioned saw some form of increase. This was significantly above the average throughout the rest of the country and reflects the heated market in London. Regional shell rents are remarkably consistent across the country averaging between £59,000 and £69,000. Increases have been relatively modest between 2% and 7%. In addition, only approximately half of all of reviews actioned have seenany form of increase. We have also noticed some properties have been subject to regearing or re-letting following closure. This has resulted in decreases in some rents; perhaps reflecting the secondary locations of the units, where business failure is more likely.

Conclusion

Over the next 12 to 18 months the Brexit negotiations are likely to dominate. Until we know the outcome of these negotiations there is likely to be continued uncertainty in the economy. With rising inflation there is likely to be an interest rate rise, which will start impacting on people's spending power. This may have a disproportionate impact on those with bigger loans and mortgages and impact upon people's spending power, particularly the leisure spend.

Royal Sovereign - Brighton

We have already seen signs that the housing market is starting to slow. We are seeing retail price inflation outstripping wage inflation, again reducing the spending power of individuals.

With these potential economic uncertainties there could be a knock on negative impact on rental values as demand for leisure space may weaken. Despite this, Fleurets still consider that the licensed and leisure sector remains strong with the general quality of stock in the UK improving. Closures of poorly located properties are being replaced by modern, better placed properties, more able to meet 21st Century customer demand.

Cross Keys - London

It is our firm belief that both landlords and tenants should obtain sound professional advice from people who understand the nuances of agreements and transactional evidence and have an in depth knowledge of the markets. There are many pitfalls for the unwary. Fleurets is here to provide professional advice whenever you need it. Please contact any of our offices to discuss your requirements.