Survey of Pub Prices

08/01/2019

Click here to view the complete PDF

Market Overview

- Freehold sale price £445,537 +6.9%

- Bottom end sales reduce as prices increase +1.9%

- Leasehold volumes down -21.6%

- Increase in package transactions

- Growing number of fitted pubs on free of tie leases

- Higher quality disposals with FMT upto £315k (£274k)

*FMT - Fair Maintainable Trade

Market Commentary General

The pub property market is very specialist, but it is also very diverse. It is made up of lots of subsections, each of which has its own market conditions and variables that affect the saleability and value of each operation. The variables include:- size, location (city/suburban/country), region, operational style (wet or food-led), premium or value, managed or tenanted, freehold or leasehold, fitted or shell, tied or free of tie, continued use or alternative use etc. Understanding the buyers for each sub section, their requirements, motivation, ability and appetite to acquire, is key to understanding the likely sale price of any licensed property.

Transactions in the pub market have always been dictated by the availability of finance. The more buyers with funding the higher the demand and vice versa. The effect that funding has on some subsections of the pub market has never been so diverse, especially in the North of England.

There is no shortage of buyers with plenty of cash wanting to buy and there is no shortage of talented operators wanting to operate, but in certain sections of the market there are very few buyers who have both the money and the ability to operate. The combined effect is that there are several types of property that are in strong demand and several types of operation where demand is very limited.

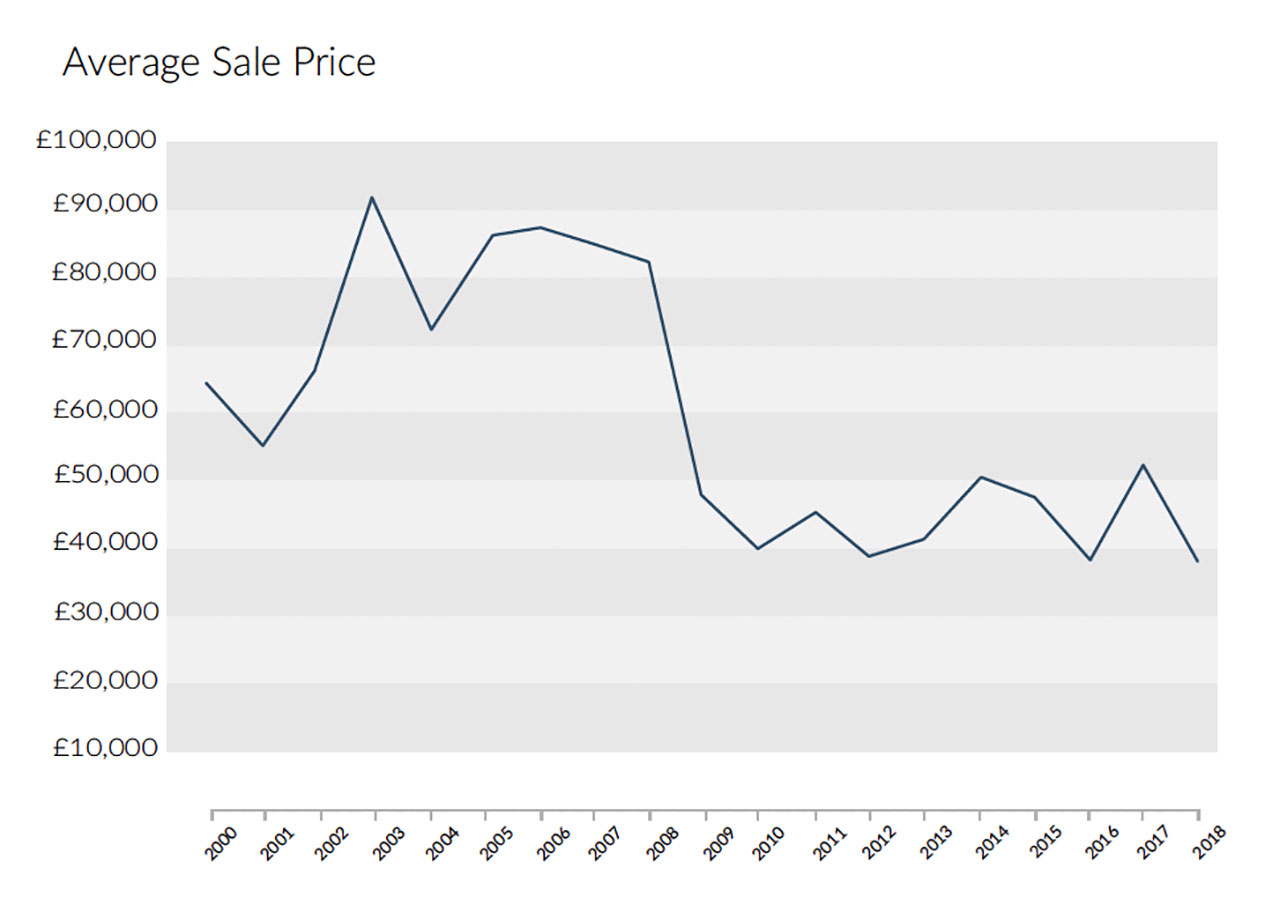

The peak of the "forced" supply of pubs onto the market was between 2009 and 2011, with the bottom of the market in terms of value in 2011-12. The overall volume of transactions has remained steady in the last 3 to 4 years, but market demand has polarised with the best sites being in strong demand and secondary sites generating much lower levels of interest.

Types of operation with strong demand

High quality sites suitable for managed operation - These are typically sites that take over £12k pw for wet-led and over £20k pw for food-led units.

City centre sites in strong demand from all types of buyer.

Bottom end freehold pubs - Affordable to individual operators and local developers.

Leisure investments - Driven by the appetite of pension funds and private investors attracted by longer leases often with RPI provisions and higher yields than other sectors.

Nil premium free of tie leaseholds - Very little cash is needed, so enthusiastic operators can secure what is often a fitted unit with an opportunity to trade.

Package deals - Strong demand in the last 12 months from operators and investors.

Types of operation with less demand

Mid-sized, often owner-operated businesses - These can be very successful and attractive operations, but they do not fall into any of the active buyer markets. Many are too small and/or too individually driven to operate under management, too food-led to operate under a tied tenancy model, and they require too much of a cash deposit for individuals to raise a bank loan to purchase. A 40% deposit plus costs is often far more than most private buyers can afford when purchasing a business between £500k-£1m, particularly in the North and Midlands.

Leasehold assignments at a premium - For all but the very best sites in the major city centres, significant assignment premiums are very hard to achieve. This is due to a growing number of free of tie units being available on new leases. These are often fitted premises and offered either at lower rents or with better incentives than existing leases on assignment.

The Chequers Inn, Hope Valley, Derbyshire

Portfolio Transactions

At the beginning of 2017 there appeared to be very little appetite for large package deals in the pub market, however, in the summer of 2017 this all changed, with three significant deals taking place within a couple of months. These included:-

- The acquisition of 73 Mitchells & Butlers managed houses by a private investment fund for a reported £42m.

- The acquisition of the Admiral Pub Company, by Proprium Capital and C&C, totalling 853 predominantly freehold tenanted public houses for a reported £220m.

- Heineken and Patron Capital joined forces to buy Punch Taverns' estate comprising 3,250 predominantly freehold tenanted public houses for a headline price of £1.8bn.

These deals led the way for more package transactions in 2018 than we have seen for many years. Buyers included existing operators, venture capital companies, private investment funds as well as individual private investors; each buyer with their own criteria and motivation.

Most investors wanted freehold assets but some considered leasehold estates. Some wanted managed businesses, whilst others wanted tenanted operations. Some only wanted larger portfolios whilst others would consider smaller more regional groups. The variations have been plentiful, but the key element was that there has been an appetite to acquire groups once again.

The motivation varied depending on the buyers; from trade buyers looking to expand to increase economies of scale, to private investors attracted by a strong asset backed cash flow,this is despite uncertainty in the face of Brexit, and with or without alternative use opportunities to extract.

Corporation Arms, Longridge, Lancashire

Looking ahead

Values are steadily increasing and turnover in the pub sector is remaining firm (allowing for inflation, sales in pubs are still in line with 2008, according to the Office of National Statistics). Operators who are adaptable, creative and resilient are focussing on premiumisation, service standards and quality to differentiate their offer. However, cost headwinds and falling consumer confidence are focussing attention on bottom line profits, not helped by the protracted uncertainty over Brexit.

Increasing costs and more selective consumers are encouraging a trend towards specific concepts with fundamentally lower overheads, for example micro pubs with a craft ale focus or gin bars that cater for a niche market and also operate from smaller premises. They are very clear about their offer, often trading on just wet sales, or with a very limited and simple food offer, in order to keep costs to a minimum, thus enabling good profit to be made from modest turnover levels.

The food offer in pubs is expected to polarise, with large operations getting bigger, thus driving economies of scale; whilst smaller scale operations, which are often owner operated, will be restricted on what they can offer due to staff limitations. The middle market will be under pressure to simplify and de-skill their offer in order to minimise the effect of rising wage costs and staff shortages.

There will be a continued closure of small outdated pubs that can no longer cater for changing consumer demand, alongside growth of larger more modern operations that meet the current consumers' needs. The ONS reports that in the last 10 years 41% of small pubs have closed, whereas medium and large pub numbers have increased by 16%. The numbers equate to a ratio of 7 small pubs closing to every 1 large pub opening, which isn't expected to change in the short term.

Portfolio transactions will continue to gain pace, partly driven by strategic and selective acquisition of brands and/or to generate economies of scale, and partly opportunistic transactions resulting from the administration of smaller, highly geared leasehold operations, that have failed to meet their forecast trade levels. The variety of purchasers will broaden as a result of interest from wider investor platforms, nationally and internationally.

Eagles Head, Carnforth, Lancashire

The three pub categories explained:

Bottom End Freeholds - These are properties generally sold without accounts, sometimes closed or vandalised or, if operational, under temporary tenancy/management arrangement. These are primarily pub company sales but also include administration sales and occasional private sales. Invariably they reflect some form of forced sale situation.

Freehold Freehouses - These are generally better quality pubs sold with the benefit of accounts with an unrestricted marketing period. They are operational and typically viable businesses, usually sold by private individuals, but also by managed house operators and not in a distressed situation.

Leaseholds - This group covers a wide spectrum of properties including high street bars, community locals and destination food houses. The transactions include free of tie and tied deals, on assignment, letting and underletting. Some deals reflect a negative value due to reverse premiums being paid or sub lettings at a lower rent than the passing rent.

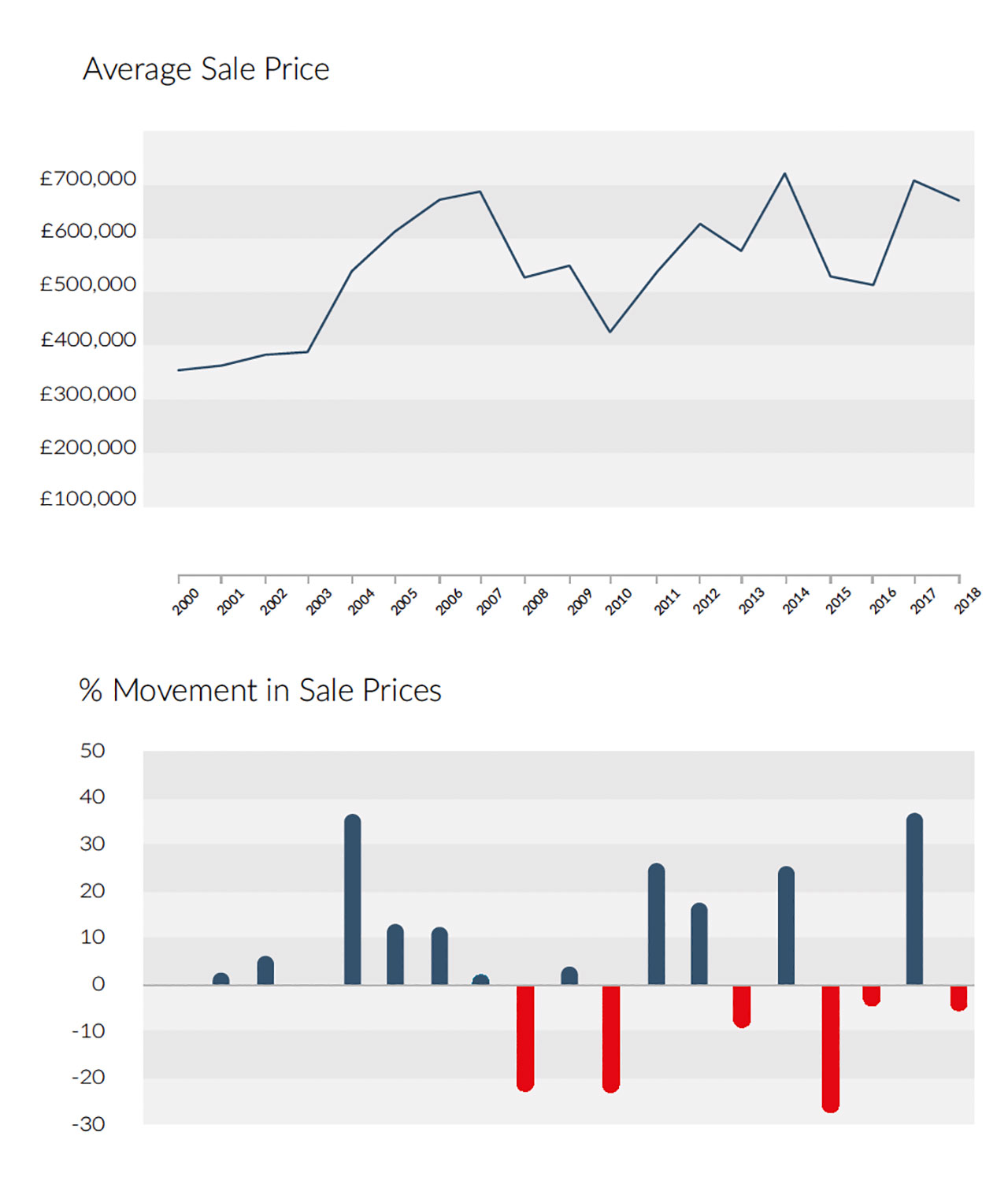

Freehold Freehouses

- Average freehouse sale price £675,964

- Southern regions all see increase in average sale price

- Fewer London freehouse transactions

- Increase in sale prices in the North, up +40%

- Average FMT of sold pubs increases 15%

FMT - Fair Maintainable Trade

Across all regions the average sale price of a freehold freehouse pub was down -5%, to £675,964, with sales equating to a multiple of 1.54 x Fair Maintainable Turnover (FMT) (2017 1.89). This reflects a significant change in the location of transactions, with more in the North and fewer in the South; not an inherent value change.

The average sale price in the South was down -5%, however, this reflects a change in the regional balance of transactions, with fewer deals in London taking place. In London average sale prices were slightly ahead of last year, reflecting an increase in the average FMT. In the South and West regions, sale prices were up 5-10% benefitting from average FMT levels increasing by 20%, whereas in the East region, sale prices jumped 60% helped by a 27% increase in average FMT.

In the North the average sale price increased by a significant 64%, however, this was heavily influenced by the transaction of a managed house portfolio. Excluding the portfolio deal, the average sale price was still up over 40% driven by a 20% increase in FMT, further demonstrating that higher quality operations were being sold.

Transaction volumes were up 20% nationwide, led by transactions of corporate style operations to corporate buyers and developers. Private freehouse transactions continued to be limited by the availability of cash finance, due to the loan to value (LTV) ratios available for pub transactions.

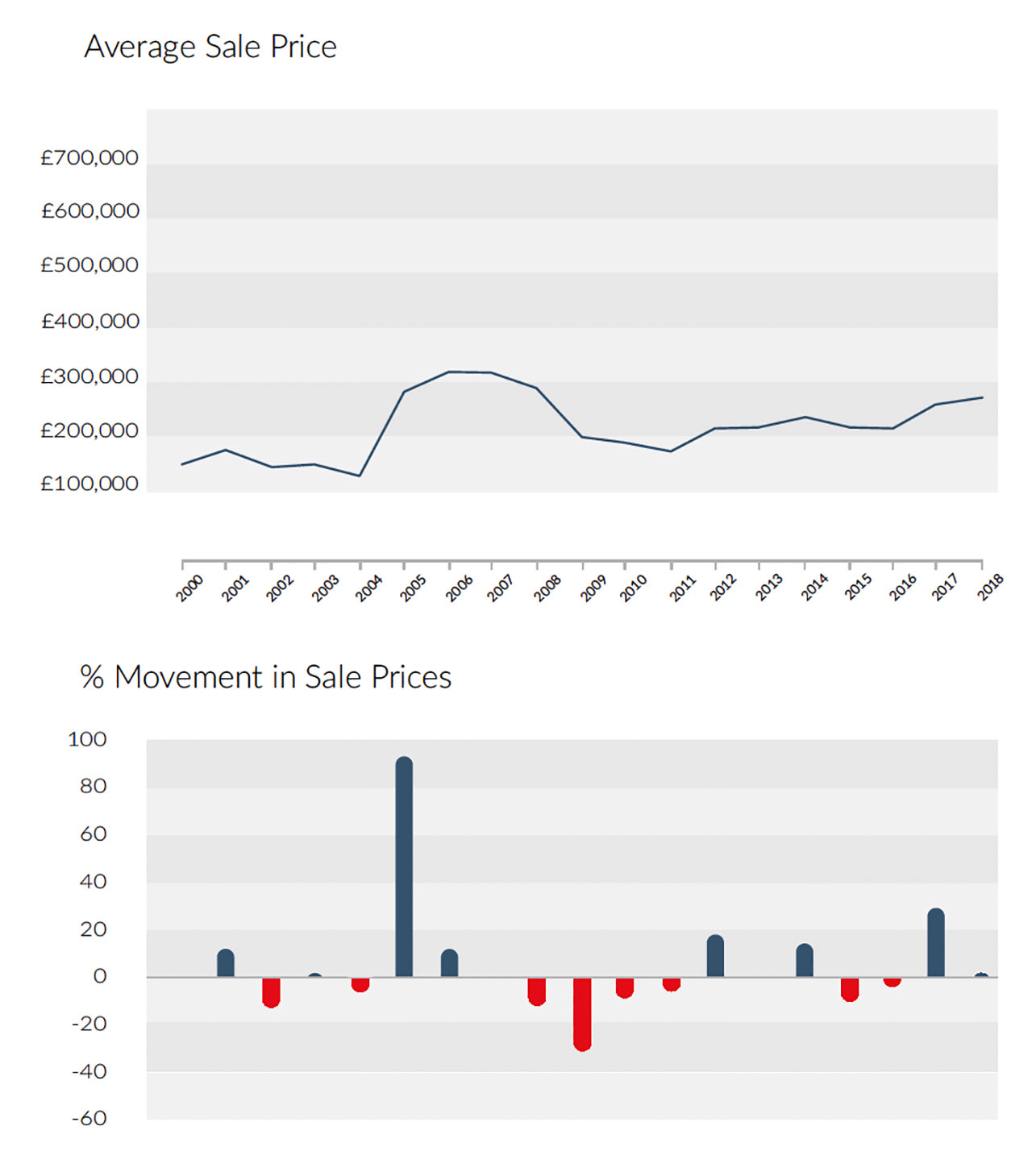

Bottom End Freehold Pubs

- Average sale price increases by 1.9%

- Sale price in the North up 6% to £224,000

- Sale price in the South up 9% to £396,000

- Multiple of FMT 1.12 North & static in the South 1.39

- Average FMT static in the North and up 8% in the South

- Volume of sales down by -19%

The average sale price of all bottom end freehold pubs was up 1.9% last year, partly as a result of a marginal increase in FMT of 0.7%; and despite a significant reduction in sales in the South compared to the North.

Sale prices in the North increased 6% to £224,000 despite average FMT remaining static (up 0.6%), suggesting similar quality sites have been selling for a higher price than last year. This is supported by an increase in the sale price as a multiple of FMT, increasing to 1.12 (1.06).

Sale prices in the South increased 9%, however, the average FMT of pubs sold was 10% higher, suggesting the higher sale prices are a reflection of better quality properties being sold, as opposed to a movement in value.

The volume of bottom end sales decreased by -19% (-7% in the North and -37% in the South) as many pubcos retained and invested in underperforming assets, rather than sell them, and administration sales of individual freehold pubs remained low as trade levels held up and debt holders continued to support operators. This would also suggest we are nearing the end of the big pubco's disposals programmes.

Leasehold Pubs

- Average sale price down -27%

- Multiple of FMT in the North static at 0.1

- Multiple of FMT in the South down to 0.11 (0.13)

- North - average sale price £32,783

- South - average sale price £40,481

- Volume of sales down -22%

The average sale price of leasehold pubs was down -27% last year as a result of fewer prime leasehold assignments taking place. This was supported by the average FMT reducing by 13% as the quality of leasehold opportunities being sold/let declined.

The volume of transactions was down -22%, potentially reflecting a lack of confidence but also a reduction in the availability of viable opportunities. We saw a similar reduction in transactions between the North and South. This is despite seeing an increase in the number of fully fitted free of tie lease opportunities coming to the market from landlords, including Wellington Pub Company, EI Group and private individuals choosing to let instead of sell their business.

The sale price as a multiple of FMT held firm in the North at 0.1 but reduced in the South to 0.11 (0.13). The average FMT didn't vary significantly being £330,000 in the North and £380,000 in the South.

The leasehold market has continued to be difficult. The supply of pubs as new lettings or as nil premium leasehold assignments has remained high, giving buyers plenty of choice and keeping many premiums (inclusive of F&F) at or about one times the EBITDA.

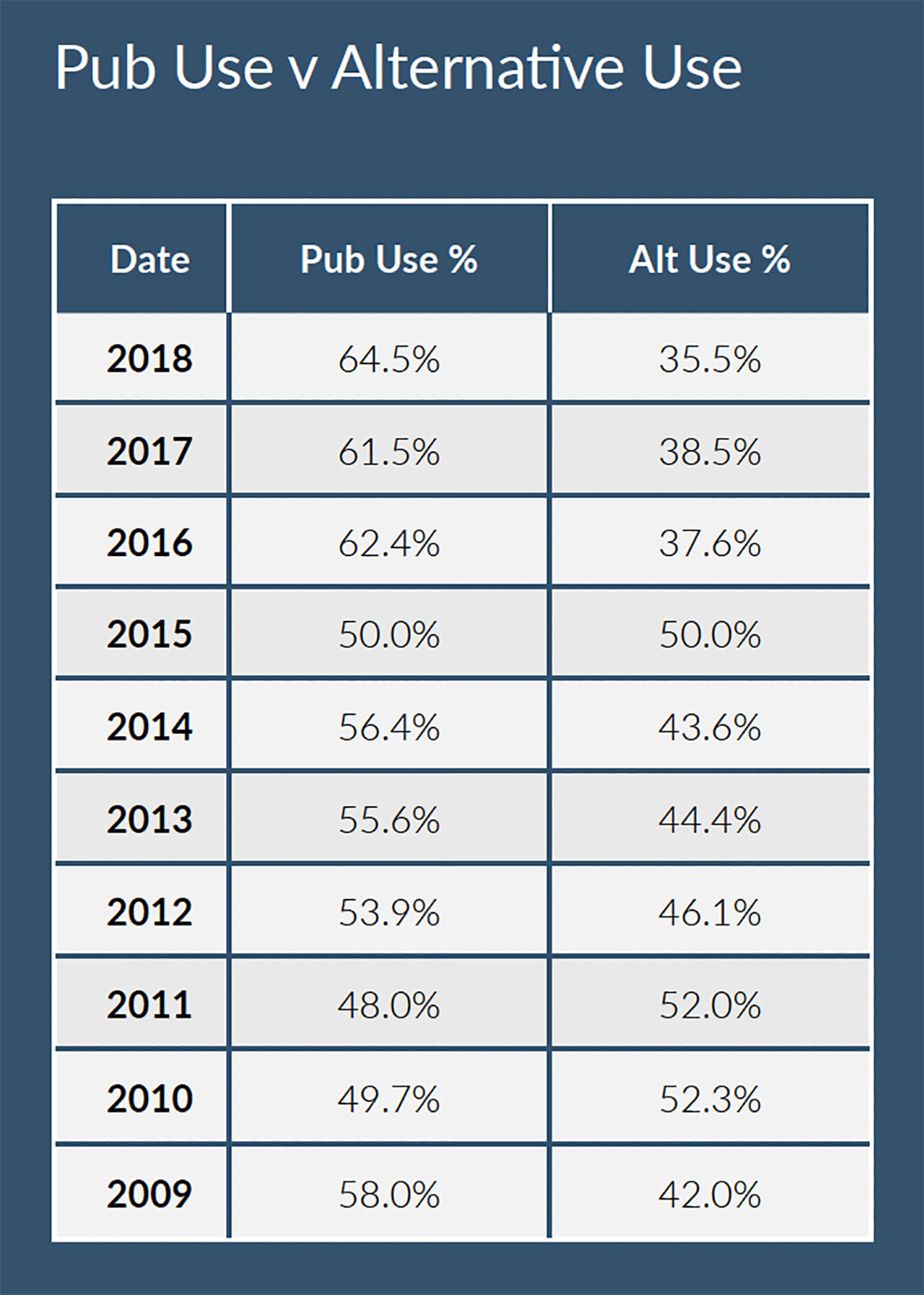

Pub Sales - Alternative Uses

- 64.5% of all freehold pub sold remained as pubs

- No regional variation in use between the North and South

- Bottom end pubs in the North sold for 2% more than for non-pub use

- Bottom end pubs in the South sold for 10% more than for non-pub use

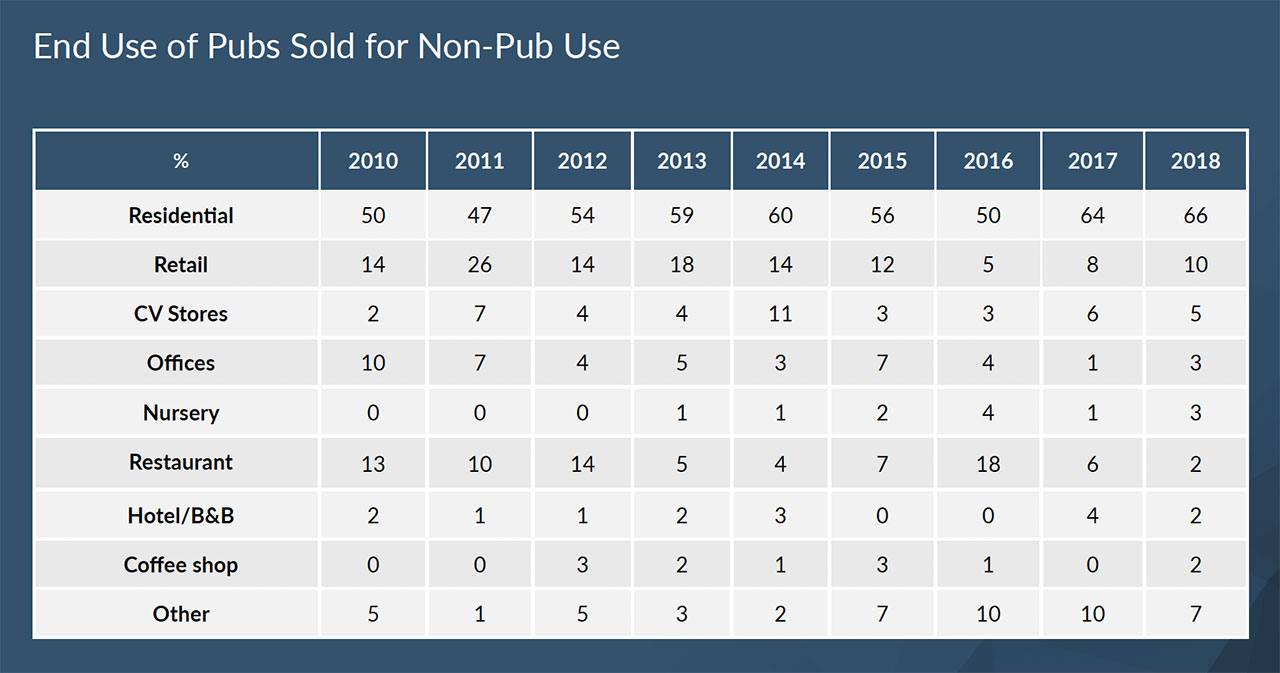

- Sales for residential use increased to 66% of all non-pub uses

The percentage of freehold pubs that stay as pubs after being sold has increased in 6 out of the last 7 years, now accounting for 64.5%. This is split between bottom end pub sales where 52% were sold for non-pub use and freehouse sales where 90% stayed as pubs after being sold.

There was little difference between the North and the South, where both experienced almost two thirds of all freehold pub sales staying as pubs.

The average sale prices of bottom end pubs for pub use was 2% higher than for non-pub use, whereas for freehouse sales the average sale price was 10% higher for pub use.

The most common alternative use was residential, with an increased percentage of the overall sales being sold for this purpose at 66% followed by retail at 10% (8%) and convenience stores 5% (6%). Uses which saw a decline in numbers included restaurants 2% (6%) and hotel/B&B 2% (4%). More common uses included offices and children's nurseries which were both up to 3% (1%).