On Market - 2015 - Issue 1

09/03/2015

Click here to view our online pdf reader.

Click here to open the pdf directly.

A comprehensive review in a magazine format with topical and informative articles from both experienced Fleurets staff and from external trade organisations, to inform and advise, including a round up of property availability nationwide, broken down by region and by sector that displays the extent and variety of opportunities on the market.

In this issue:

- London's burning - The central London market has experienced a strong surge in demand from both home grown and international operators.

- Rebirth of UK independent brewhouses - Looking at the growth trends in the public house sector and the return of traditional core values.

- Return of the provincial market - Examining the exceptional level of activity provincial hotels have experienced.

- Trade Insight from M&C Report and Allegra Foodservice

- Trends in the 2014 pub property market - 2014 saw a turning point in activity involving the switch from a market dominated by large volumes of forced or distressed disposals, to being a divided market with regional discrepancies.

- Business Rate Appeal - Don't miss the deadline! Appeals to challenge must be lodged before 31st March 2015.

- Hotel commentary and properties for sale

- Restaurant commentary and properties for sale

- Investment commentary

- Pub commentary and properties for sale

- Leisure commentary and properties for sale

M&A Activity delivers sparkling performance

Martin Willis - Managing Director

2014 truly saw the return of the 'M&A' markets across the leisure property sector. Q3 and Q4 continuing to deliver a pace and volume of deals not experienced for several years, much of which has involved the provincial markets, moving away from London's dominance.

The hotel sector has seen a wealth of substantial single asset and corporate transactions. The De Vere Group absolved itself of its assets in a series of transactions; KSL Capital Partners acquired 25 Urban Village Resort hotels, Sankay Advisors and Canyon Capital Advisors acquired the De Vere Hotels and Luxury Lodges, and De Vere Venues went to Starwood Capital Group earlier in the year.

Not wanting to be overshadowed, the restaurant sector saw Hony Capital acquire Pizza Express in a £900m deal and Hugh Osmond acquired 43 Strada Restaurants from Tragus for £37m. More recently TPG Capital reached agreement to buy the Prezzo chain for in excess of £300m and the sale of the ASK and Zizzi restaurants (245 units) to Bridgepoint was agreed for circa £250m.

The pub sector continued to grab the headlines, this time with the House of Commons vote to support an amendment to the Small Business Enterprise and Employment Bill. Subject to Royal Ascent, this will permit large pub company tied tenants to choose between a tied agreement and free of tie market rent only agreement, which in turn could have far reaching consequences on the structure and modus operandi of the leased sector. The managed pub sector was not to be outdone with terms agreed for Greene King to acquire Spirit, which will see the group control circa 3,000 pubs.

In the wider leisure sectors, transaction news was more mixed. No Saints completed a pre-pack administration and Rileys Sports Bars was placed into administration. More positively Electra Partners acquired the Original Bowling Company for circa £91m and Luminar Leisure acquired the eight strong Chicago Leisure business.

The abundance of activity in the sector is reflective of the many varied opportunities that exist and are presenting themselves, whilst also being testament to the perceived strength, sustainability and growth potential of investments and businesses operating in these areas. It reflects the growing level of confidence that operators, investors and private equity groups have in the UK leisure property sector.

London's burning

Graham Campbell - Head of Restaurants

During the last 12 months the Central London market has experienced a strong surge in demand from both home grown and international operators. The competition for suitable properties has pushed rental levels in certain locations to the point, where some of the mid market operators are finding it increasingly difficult to compete with the new higher end entrants, many with money to burn.

This situation has been exacerbated by a commensurate lack of supply. Property is not a liquid commodity and any readjustment to redress any imbalance takes time. The nature of the planning system, combined with a legacy of reduced developer activity post recession, has meant that new restaurant opportunities are still relatively scarce. There have been a few notable exceptions such as, Crossrail at Canary Wharf, the redevelopment of Kings Cross, as well as a number of individual landmark City Schemes such as the Sky Gardens at 20 Fenchurch St but supply has certainly not kept up with demand.

Inevitably this has increased the focus and pressure on the existing restaurant stock with premiums in the sector likewise reaching new highs and there appears to be no respite for the time being. In terms of the prime central locations, I believe we can expect a continuation of the current trend favouring higher end offers, which operate a business model more conducive to coping with the increasing financial pressures that the current market engenders.

Those operators who find themselves priced out of their desired first choice areas are having to adapt and consider alternative strategies and locations. The strategic response will vary depending on the nature and market place within which each individual brand operates. Some will focus on the regions and others perhaps on International expansion but within London the ripple effect created by increasing cost is forcing operators to look to new previously untried areas, to deliver the expansion plans expected by their ever pressing financial backers.

Many operators have widened their focus from the traditional safe heartlands of the West End, Covent Garden and Soho, to areas such as Fitzrovia, the City and previously more unfashionable suburbs which offer more affordable opportunities and a pipeline for expansion.

For example, suburban centres such as Ealing, aided by the forthcoming attraction of Crossrail, is particularly hot and has seen the arrival of Bills, Five Guys, Wagamama, Tinseltown, Turtle Bay and Richard Carings, Limeyard within the last 12 months, complementing an already existing strong restaurant line up. Whilst still a few years away from delivery, Land Securities proposed redevelopment of the former Empire Cinema site will further underpin Ealings growing status as a leisure destination and deliver further restaurant opportunities adding fuel to the fire.

Other centres such as Brixton, which, whilst having a strong history in street food, was a location that until recently was absent from the requirements list of virtually all key operators but is now seeing its star rise. It was the birthplace of Honest Burger which is now establishing itself as one of the key players within the London Burger scene and has more recently welcomed other new arrivals, most notably Wahaca, who have refurbished the old Railway Hotel in Atlantic Road. A similar story is being played out in many previously unfashionable suburbs, including Balham and Tooting to name but a few.

Indeed former outliers such as Shoreditch and Hackney which were once off limits are also now very much on the radar and are proving particularly attractive to the new emerging brands,seeking to exploit more affordable locations and which also sit more comfortably with their alternative image.

We are fortunately in a period where we are experiencing a proliferation of new brands looking to establish a foothold within the market. Many of the newer, perhaps edgier brands, can and will benefit from establishing their identity and roots in new emerging areas, where their perceived independent nature, sits well with the cool progressive image that locations such as Shoreditch, Dalston and London Fields now confers. The recent news that Foxlow are to open their second restaurant in Stoke Newington is indicative of this trend.

The sector of the market which arguably faces the biggest challenge within London is the established casual dining brands. Their business model whilst able to work very successfully in many tourist and other retail centres, will in the current climate, struggle to compete in a market with a backdrop of rapidly increasing rents. They lack the operational flexibility of some of the new emerging offers, adopting a more corporate, fixed approach to their property requirements. As with any situation where competition becomes more intense, to ensure that they can continue to compete, they will need to broaden their horizons and consider cheaper properties with perhaps less desirable layouts, with a greater emphasis on floor space over first floor or basement than they may have previously considered.

From the landlords perspective they increasingly have an embarrassment of riches with operators clambering for the available properties in their portfolio. They now have the privilege of choice and can afford the luxury of focussing on the quality and distinctiveness of operation, with many now looking to create a tenant mix which is both more eclectic and less corporate in nature.

This naturally mitigates against the more well known mass market brands, not only financially but in respect of their operational style. It is increasingly a potential double bind that further restricts their ability to expand.

Whilst there is still an opportunity for these brands to pursue expansion into the more mature and established suburbs, they arguably lack the element of cool and independence to be able to be at the forefront of the newer suburbs inhabited by the younger Generation Y who by their nature are instinctively more likely to reject the old corporate image in favour of the aspiring independent.

As the next phase of expansion plays out over the next few years the one thing however that wecan be certain of, is that London will continue to burn brightly. Ultimately we will end up with a more diverse market, both operationally and geographically, which will be to the benefit of the consumer at large.

Rebirth of UK independent brewhouses

James Davies - Divisional Director

One of the few positives of a recession is the realisation that if we are to survive an economic trough one has to be at the very top of their chosen field. This requirement for excellence has generated a boom in innovation as many companies seek to separate themselves from their respective competition in order to survive.

This principal runs through the veins of the leisure sector whether it be a hotelier, restaurateur or publican or even a specialist service provider such as Fleurets.

One of the most fascinating growth trends has been seen in the public house sector. Some ofthe biggest success stories have been attributed to the return of traditional core values, most noticeable, in the rebirth of UK independent breweries and public houses offering on-site microbreweries.

In the UK there are approximately 1200 brewers which is at its highest level since before the Second World War. In London, which was one of the greatest brewing centres in the world, the number of brewers has almost doubled in recent years to a figure approaching 50.

This revival has seen a number of different chains opening around the country with a wide selection of traditionally crafted Artizan beers being presented in all kinds of sizes, shapes and of course ABVs!

One of London's most successful independent pub operators, ETM group have recently painstakingly refurbished the Ealing Pub Tavern in west London specifically to recognise its history dating back to 1728 when it operated as the Lewis Fernell Brewhouse. It is now re-opened in all its glory offering its own in-house microbrewery providing the customer with fantastic theatre to complement the drink and food menu on offer.

Tom Martin of ETM stated: "We are extremely excited to be brewing our own ales for the first time at Ealing Park Tavern. Our brewery produces its own range of beers including bitters, pale ales and season brews and we have an on-site Brewmaster who is available for customers who want a tour of the brewery, tasting sessions or simply to match the beer to their chosen menu". "It is fantastic to return the pub to its roots with the onsite brewery and the customer feedback has been extremely positive. Where viable we look forward to exploring similar opportunities for any future acquisitions".

A similar success story can be seen with the creation of Brewhouse & Kitchen which is a rapidly expanding chain of public houses with on-site breweries.

Brewhouse & Kitchen started trading in 2012; the company was created by Simon Bunn and Kris Gumbrell. They made their first acquisition which was The White Swan in early 2013, a former Wetherspoons in Portsmouth, and have gone from strength to strength amassing five freehold and two leasehold pubs with more sites to follow.

Kris Gumbrell commented "We had been selling a large range of alternative bottled and keg beers for two years prior to us trying the Brewpub model in Convivial. The scene was set and we knew we wanted to do it differently from the perceived norm. The writing was on the wall in terms of beer, we were in a recession and the mainstream beer brands and big pubco operators seem to be in a race to the bottom in terms of price and quality. The world waszigging, we decided to zag".

"When we decided to create Brewhouse & Kitchen, we had learnt a lot already, we knew we had to build a brand, the concept needed to be bold and innovative. If we wanted to get to the forefront of the new movement we needed to make the brewery live and breathe at the centre of the business, not be some hermetically sealed bit of bric-a-brac behind plate glass with an invisible brewer".

Today the company operates four Brewhouse & Kitchen sites, one is under development as we go to press and two more await conversion.

Brewhouse & Kitchen sees itself as being an anti-brand brand when it comes to beer, "we steer away from competing with the big guys, we charge a fair price but never lose sight that we are and must be seen as an Artisan business because we pretty much are. Our own beers represent about 50% of all our draught sales, despite the fact we carry a range of about 26 to 30 keg and draught products, including at least six of our own. Range is expected but we have to be good value and our own beers are the stars of our show. At our Angel site prices start at £3.50 a pint for our standard beer, £2.70 in Portsmouth, that is the price. No card tricks and it is much appreciated".

Food sales amount range from 38 to 48% of overall sales, and are key to the success "We talk to a lot customers all of the time. They don't expect us to give them fine dining or a gastro experience, but we do know we can't give them 'sous vide roast belly pork' from a plastic bag, previously cooked in some industrial unit. We cook on-site, we using a lot of our own beers in nearly everything we do. We need to be authentic and have character".

The team believe in keeping it simple and doing it well, the biggest sellers are fresh burgers, ribs and the signature Beer Can Chicken, which serves up to four guests. Chips are handcut, wet fresh fish is beer battered to order and every dish on the menu has a recommended matched beer, even the puddings and the pork crackling.

Brewhouse & Kitchen takes it inspiration from the US brewpub market, "it is massive in the States, there were over 1200 by the end of 2013 with growth in numbers of about 7% per annum, and their origins predate the recent Craft beer phenomenon which is also taking hold and helping to reinforce what has been there for some time, US brewpubs are still finding themselves in a rising market over 30 years after they took off, so we hold big hopes for the UK market. We are often asked if the model is scaleable and we firmly believe it is when you look at the size of such businesses as BJ Restaurants and McMenamins. They have nearly 200 between them which is amazing when ones considers US does not have the big pub companies or brewer pub operators that we have in the UK who can invest at this level. BJ's were recently quoted as believing they can get to 425 units on their current trajectory in a market that can comfortably take that number".

"In terms of the future, we are not looking to build too quickly, every day is a day at school for us, other players are coming in and some are already there, we look at every competitor we can and then focus on the consumer and delivering a unique experience. We want our business to be one with grown up pubs for grown up people, so we need to be consistently good and not cut corners on what makes us unique".

These examples from the ETM Group and Brewhouse & Kitchen are just two of many different styles, sizes and types of operators whom are driving forward the obvious marriage value between brewery and public house and judging by their fantastic success we have some very exciting years ahead of us as consumers!

Return of the provincial market

Paul Hardwick - Director & Head of Hotels

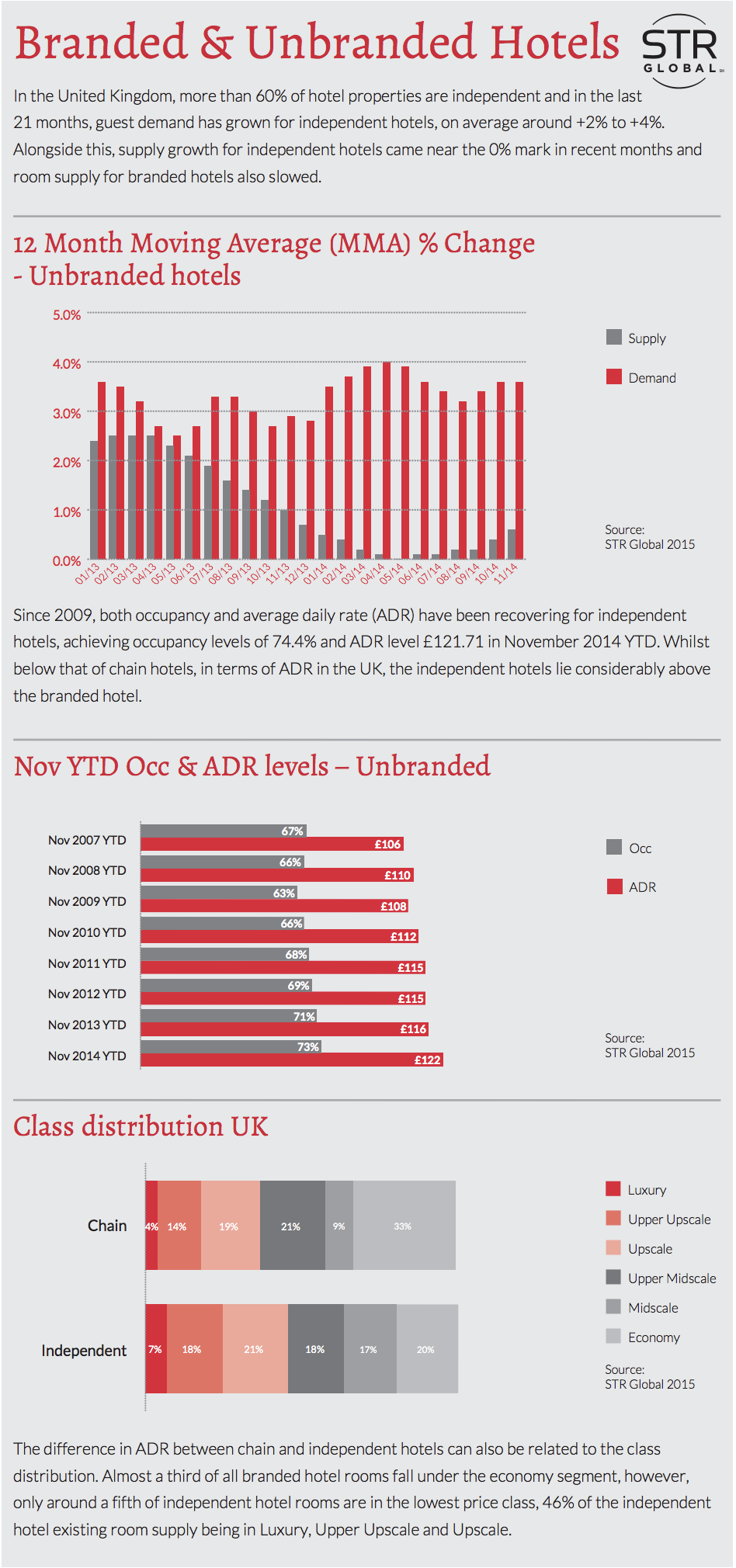

Due to a combination of market and economic factors, alongside the growing dominance of branded hotels, many have speculated that we would eventually see the demise of the unbranded provincial hotel. Such hotels have been under attack from all angles, be it economic pressure, difficult trading conditions, and new/improved competition at all service levels. That said, this market is by no means dead.

Provincial hotels have recently experienced exceptional levels of activity, most recently evidenced by the Topland acquisition of a portfolio of eight hotels from the Feathers Group providing 726 bedrooms. This is the latest acquisition in Topland's investment strategy to grow its regional hotel portfolio, having spent approximately £200m on 28 hotels in just over one year.

Sector confidence has been bolstered by improving trading performance, hotels generally showing positive key performance statistics, which is anticipated to continue for the foreseeable. In addition, many purchasers perceive this sector of the market to offer several opportunities for strong income and capital growth, and thus it is considered by many as a good value investment arena.

Unlike the market in the capital, there are more provincial group/portfolio acquisition opportunities, allowing group level purchasers to improve business efficiencies through the incorporation of individual and small numbers of hotels into a larger 'machine', thus growing profitability. In addition, in many instances, provincial hotels are suffering from the usual recessionary symptoms of under investment and under performance. As a result, an obvious purchaser opportunity is capital investment supported by new motivated management driving performance. Hotels in this sector often offer branding opportunities, at a much lower cost than new build. Many hotels also offer value added opportunities through intensive asset management, for example, through surplus land development or disposal.

As ever, growing activity in one area of the market typically leads to rising prices, as more new buyers jump on the acquisition bandwagon. A growing pool of buyers set against a diminishing number of the perceived best 'value' opportunities, means competition intensifies, leading to upwards pressure on hotels pricing.

The price expectation gap between nondistressed sellers and motivated buyers narrows, which is good news for owners but less good for buyers, as increasing pricing gradually erodes the potential 'upside' of a deal through supply/demand price adjustment. As the low(er) hanging fruit is picked, buyer interest spreads to the next best opportunities. This may be to the benefit of hotel owners that have been holding out in the hope that the market catches up with their price expectations. However, economic uncertainty continues to be the elephant in the room and there is a risk that owners holding out too long for too much might well 'miss the boat'.

About STR Global - STR Global provides clients - including hotel operators, developers, financiers, analysts and suppliers to the hotel industry - access to hotel research with regular and custom reports covering Europe, Middle East, Africa, Asia Pacific and South America. STR Global provides a single source of global hotel data covering daily and monthly performance data, segmentation data, forecasts, annual profitability, pipeline and census information. Hotel operators can join the surveys on a complimentary basis and benefit from free industry data. STR Global is part of the STR family of companies and is proudly associated with STR, STR Analytics and Hotel News Now. For more information, please visit www.strglobal.com.

Caught in the maul

Mark Wingett - Editor, M&C Report

It is not a technical term, but the word that many operators have used to sum up their thoughts on the next 12 months is mental. Competition will continue to be fierce with all the on-going challenges that brings with it. It may be a cliché, but finding the best people and property in an increasingly crowded market place will provide the biggest challenges, alongside harnessing technology. It will also be a year when many of the established brands will have to reaffirm their credentials against a growing wave of younger, nimbler operators with national growth aspirations.

The past year saw a shake-up in the ownership at the "big boy end" of the restaurant sector, with eight of the top 20 brands in terms of size either changing hands or floating. The set up at multi-brand operators such as Gondola and Tragus changed considerably, and it will be interesting to see how the changes at the latter's Café Rouge brand work out. Thankfully for the now Apollo-backed Tragus, the continued resurgence of Bella Italia will give it some breathing space on its turnaround of its sister brand.

The future direction of Prezzo and its chief executive Jonathan Kaye will be clearer over the coming months. New owners TPG Capital are expected to beef up what has always been a very streamlined head office and operational team. Many expect Kaye to move on after 11 years building up the c250-strong business.

It will also be a big year for Wagamama and YO! Sushi. The former has taken a bold step with its new format design at its Uxbridge site, which has been positively received so far. Flagship sites at Soho and Gatwick will also be unveiled this year, adding further to the momentum that has returned to the brand over the last six to 12 months under David Campbell.

Just outside the top 20, relative newcomers Bills, Côte, Byron, Itsu and Loungers will continue to grow their national presence, with at least two of them (maybe even three with Côte believed to be growing and performing ahead of expectations), due to come to the market over the next 12-18 months.

News last week that Byron and Wahaca were two of the first handful of brands to sign up to Southampton's WestQuay Watermark development, shows how the landscape is changing in the regions and how the challenge for the more established brands is to stay relevant, especially with the next tier of concepts, such as Pho, MeatLiquor, Turtle Bay and CAU flexing their expansion muscles. Talking of scrums, unlike its football cousin, there has been no great fanfare at the start of this year about the impact of the UK hosting the Rugby World Cup in September. With all of the Home Nations expected to do well, the event provides an excellent opportunity for pubs across the country. By that time we should have more of an idea of how the country's biggest pub group, the newly Spirit-boosted Greene King will be configured. It should provide challenges and opportunities for both the group and the sector.

With Enterprise already well down the road of exploring different trading models, the spotlight will be on Punch and to a lesser extent Admiral Taverns, to see their reaction to Parliament's decision to introduce a market rent only option. And what now for the May Capital-backed Hawthorn Leisure? It's goal to reach 1,000 sites may have to be recalibrated, while speculation persists that the newly created pub group's initial performance hasn't yet matched expectations.

Last week, Prime Minister David Cameron said fuel prices at the pumps should fall "further and faster" after a significant drop in oil prices, which will be music to the ears of leisure park operators and destination pubs, with the latter set to put more pressure on the former this year.

Finally, using a mixed rugby analogy, food-led pubs and the less established restaurant concepts have got a nudge on at the consumerattracting scrum going into the next 12 months, but I expect the more established operators to do some much needed counter rucking as theyear progresses.

Confidence over pricing returning

Simon Stenning - Executive Director, Allegra Foodservice

Menu pricing analysis conducted by Allegra Foodservice during October 2014 draws upon the assorted pub and restaurant menus captured within the 120 profiles on the Restaurant Brand Portal (www.restaurantbrandportal.com). From looking at year on year movements, it is apparent that business confidence is returning, not least in the way that restaurant operators are increasing entry level prices.

Allegra's analysis looks at Entry, Typical, and Exit prices, from all menus, categorising them by casual dining, fast food and pub restaurants. The highest price rises were seen at the entry level, with the average entry price for mains showing a significant jump of 4.2% across all of the sectors, demonstrating that operators are becoming more confident with the improving economic outlook. Between 2012 and 2013, mains entry prices only increased by 2.2%, which further highlights this returning confidence, especially given that food cost inflation has been decreasing.

Importantly, however, not all prices are increasing, as the analysis shows that Exit level prices have decreased. Exit level mains prices were lowered on average by -2.5%, suggesting continuing price sensitivity at the highest price levels. Whilst the theme of Premiumised Informality that Allegra described in the 2014 UK Restaurant Market report continues to play a key part for the industry, consumers have become engrained with a value seeking mentality following the recession, and have shied away from higher exit level prices where they feel the value for money is uncertain. Subsequently, operators have removed or reduced some exit level prices, such as at the bar-restaurant group Balans, which reduced the price of its 10oz rib eye steak from £22.50 on its winter 2013 menus to £19.95 this year.

The analysis also shows that pubs are now competing strongly with fast food chains in prices

of cheapest main courses! Value-led pub chains and selected mainstream pubs are now offering similar pricing points to fast food operators. As an example, M&B brand Sizzling Pubs offers a smaller portion of scampi & chips for £3.49, compared to a Big Mac meal for £4.19. This shows how pub chains recognise that consumers' repertoires run across casual dining, fast food and pubs, and that in order to maintain visit frequency, their offer needs to compete strongly on price-led grounds.

Future outlook for menu pricing

Allegra believes that greater stabilisation in price rises is now to be expected. Operators have increased entry prices after years of keeping them tight, in order to meet consumers' value expectations. Allegra predicts that going forward, price increases will be more balanced across entry, typical and exit levels.

An improving economy will however, result in greater consumer propensity to trade-up, allowing for sustained top-end price rises at operators more skilfully justifying these higher price points.

Allegra Foodservice delivers best-in-class business and consumer intelligence for the UK food and beverage sector. Our services provide foodservice operators, suppliers, distributors and stakeholders with crucial market data, consumer insight and competitive intelligence.

We enable our clients to realise their corporate, strategic and tactical aims through programmes that are tailored to meet their requirements.

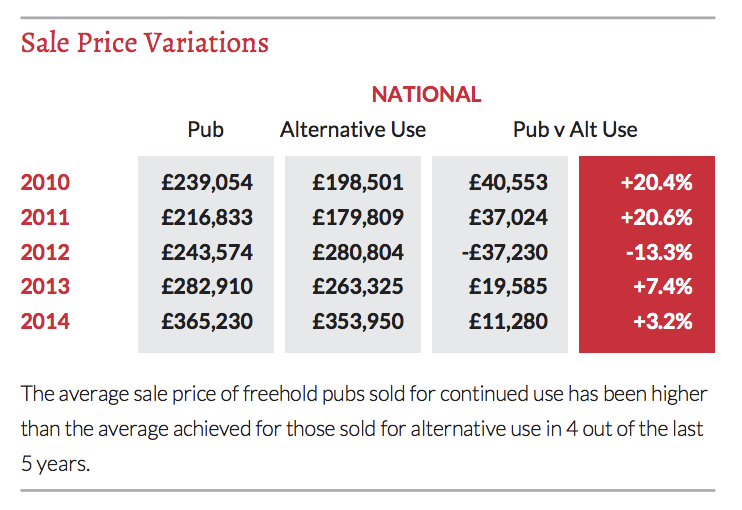

What were the trends in the 2014 pub property market?

Simon Hall - Director & Head of Agency

2014 saw a turning point in activity within the pub property market. This involved a switch from being a market dominated primarily by large volumes of forced or distressed disposals, to being a divided market with regional discrepancies in activity levels and transactional characteristics.

With improving trading figures, growing confidence, increases in residential prices and continued low interest rates, conditions were ripe for a growth in value, but with the availability of finance continuing to be restricted and varying states of economic recovery around thecountry, the changes in sale prices we experienced was regionally inconsistent.

Bottom End Freeholds

Average sale price £243,582 (up 12%)

- NORTH up 9%

- SOUTH up 12%

Overview

In 2014 the slow down of sales from the big six pub companies changed the balance between supply and demand. This not only impacted the average sale price of Bottom End Pubs but also had repercussions in the freehouse and leasehold markets.

The reduction in supply, alongside the rise in residential values, the slightly higher quality of properties being sold and a growing confidence in the economy, saw the average sale price nationally increase by 12% to £243,582. In the northern regions sale prices increased between 5% and 10% and in the southern regions values generally increased 20-25%. The south coast and East Anglia regions saw the highest increase in average sale price as the spin off from the south east residential market took effect, with 29% and 24% increases respectively, boosted by a number of particularly high value sales for alternative use in each region.

Sales for alternative use continued to play their part in the market. With the exception of a few deals, sale prices achieved for alternative uses were very much in line with prices achieved for continued pub use.

The Year Ahead

Most of the tenanted pub companies have ended their mass sales programmes. A number of pubs will still be sold, however, we expect decisions will be based on traditional case by case Estate Management Principles. Pub companies may seek to improve efficiencies and the average quality of their estates, by taking advantage of the growing interest in the sector from private equity, with many seeking to sell packages of tenanted pubs. The average sale price of individual Bottom End Pubs is likely to continue to increase, driven by the growth in residential values and reinforced by reduced supply.

Freehouses

Average sale price £726,862 (up 24.8%)

- NORTH down 18%

- SOUTH up 32%

Overview

In 2014 the average sale price of a freehold freehouse increased by 25% to £726,862, which 2007. It was, however, a market dominated by activity in the south with a rise in the number and value of properties transacted. The northern market was down on the number of transactions and down on the average sale price. In contrast, the southern regions saw a jump in average sale price and an increase in the FMT multiple to over 2x for the first time since 2008. Private owners of operational and viable public house businesses have yet to step into the market insignificant numbers, but we have seen an increase in activity across the UK as sellers, find the shortage of comparable supply is promoting encouragingly good levels of demand.

The Year Ahead

We anticipate freehouse prices will continue to rise influenced by the strengthening residential market and growing economic confidence. With interest rates not expected to rise for the next 12 months and the first signs of positive levels of disposable income, trade levels are expected to improve. This will reinforce the anticipated increase in the sale prices of good quality sites across the board.

Leaseholds

Average sale price £50,783 (up 23%)

- NORTH down 17%

- SOUTH up 35%

Overview

The leasehold assignment, subletting and lettings market started to see stronger signs of demand last year, with 5 out of 7 regions seeing an increase in the average sale price. There was, however, a marked difference in the north compared with the south. In the north the average sale price continued to disappoint, reducing in 2 out of our 3 regions whilst the multiple of FMT remained static at 0.09x. In the south the average sale price jumped 35% but remained at a consistent multiple of FMT of 0.15x.

There continues to be an oversupply of fairly average pubs in the industrial heartlands in thenorth. The economic regeneration and new found confidence that is common place in the south is less widespread in the north. There is always a market for the best sites and premiumdeals will happen across the UK, but the widespread availability is more apparent in the north and continues to affect sale price levels.

The Year Ahead

Increased flexibility, transparency and better quality operations being made available on both lease and tenancy terms, both tied and free of tie, will attract increased demand in most areas, as the supply of low cost freehold pubs reduces.

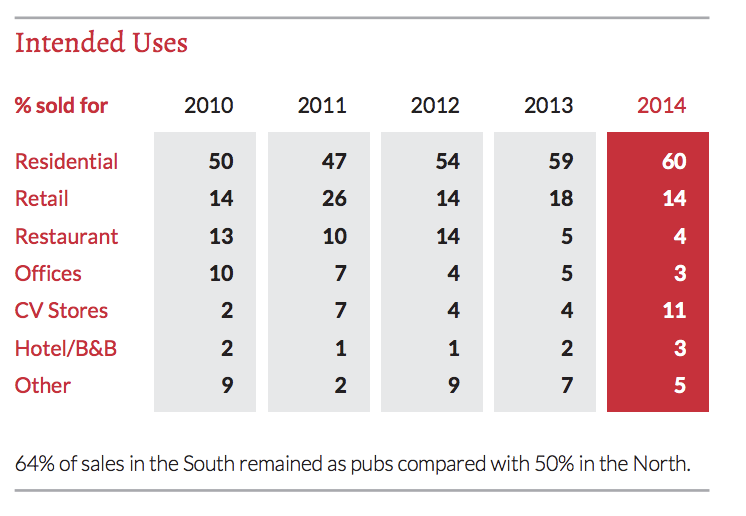

Alternative Use & Community Assets

With the protection of pubs still very much in the political glare we have undertaken our annual review of freehold pub sales, where we have first hand knowledge of the transaction. We have considered the intended uses, the most common alternative uses and the impact of pubs being listed as an Asset of Community Value (ACV).

Intended Uses

Over the last 5 years the percentage of freeholds sold for continued pub use has consistently been around 50%, however, over the last 3 years the percentage nationally has been increasing, with continued pub use rising to over 56% in 2014. The most common use has consistently been residential. The percentage being converted to housing of some sort has increased for the third consecutive year accounting for 60% of alternative use sales in 2014.

The changes reflect the increasing viability of the pubs being sold and growing confidence in the sector, as well as the improving residential market, more often leading to the values forresidential use exceeding the values for other alternative uses.

Assets of Community Value (ACV)

There are now reported to be 600 pubs registered as ACV's and it is increasingly impacting on the sale of public houses.

In 2014 Fleurets sold 11 pubs that were listed on the Register (up from 3 in 2013). We have considered each case to study the effect that the registration had on the sale process and theultimate outcome.

Sale of 11 Pubs listed as Community Assets

- 3 sites purchased by the Community Group

- 3 sites sold for Alternative Use

- 6 sites considered to have been sold for a lower price due to the ACV listing

- 7 sales considerably delayed due to the ACV listing

- In 2 cases it was felt that the ACV listing "saved" the Pub Use

- In 1 case it was felt the ACV actually prevented the continued Pub Use

- In 3 cases it was felt the ACV listing nearly prevented continued Pub Use.

On this sample of 11 sales, one additional pub was saved as a direct result of the ACV listing. However, our experience to date suggests there is a risk that an ACV listing could be counter productive, given that other sales lost a buyer for pub use because of the ACV listing and nearly resulted in the properties being sold for alternative use.

Whilst some communities have been given the opportunity to purchase their local pub, it has not however, been beneficial in all cases. It does delay sales considerably and our experience suggests it can impact on the likely sale price.

ACV's remain in their relative infancy and the volume of sales where a listing has been in placeis low. The sample may therefore be too small to draw firm conclusions, however, our experience of dealing with pubs listed as ACV's is mixed, both in terms of its benefit to the community involved and the impact on the owners. There will be further challenges and developments ahead and the Jury is still out in respect of the level of their success.

Business Rates Appeals - don't miss the deadline

Ben Peers - Surveyor

Following the government's 2014 Autumn Statement, what does this mean to operators and what does the future hold for Business Rates?

Business Rates is the third highest outgoing and is an extremely contentious issue when discussed amongst operators. The current 2010 Rating List has seen significant changes, not only due to a more bureaucratic appeal process, but also the coalition's controversial postponement of the revaluation until 1st April 2017.

George Osborne has recently delivered his Autumn Statement and we are now almost two years away from the long awaited revaluation. So what has changed? We hear continual noises from the coalition about a reform of the Business Rates system, however we are still unclear about what the future holds for this controversial form of taxation.

What we do know however, is that the coalition has now responded to consultations that took place in early 2014 on the administration of the Business Rates system. Questions have also been posed around the appeals system, the exchange and gathering of information, and the frequency of revaluations.

From the consultation, the coalition has concluded that the consensus is for individual property valuations, rather than a more 'broad brush' approach such as banding or zoning. The Valuation Office Agency will also continue to work with specialist sectors such as hotels and pubs to ensure valuation methods are transparent and can be more easily understood.

Is there any hope for the ratepayer in the short term?

Unfortunately very little. The way Rateable Values are assessed will be unchanged and the approach to valuations will continue in the usual way until at least after the May 2015 general election when, hopefully, the party or parties in power make their intentions clear.

In the meantime, ratepayers need to be proactive to ensure that their liabilities are managed to keep bills to a minimum. Complexities resulting from stop-gap tinkering with the system mean it is complicated and reduction opportunities can easily be missed.

What does the ratepayer need to know following the 2014 Autumn Statement?

The main concern for the ratepayer is that the coalition will change the rules so that alterations to rateable values can only be backdated to the period between the 1st April 2010 and the 1st April 2015 for Valuation Office Agency alterations made before 1st April 2016 and ratepayers' appeals made before 1st April 2015.

Appeals to challenge must therefore be lodged before 31st March 2015 if any retrospective benefit is to be gained. Thereafter, appeals lodged will be financially backdated only to 1st April 2015, regardless of how long the ratepayer has been in occupation. On a slightly more positive note, the Chancellor announced that the discount for pubs, cafés and retailers with rateable values below £50,000 will be increased by £500 to £1,500 in 2015.

Fleurets can help you save money!

Your Rateable Value can be appealed if it is too high and if you appeal before 31st March 2015 this may enable your business to enjoy savings until the 2017 revaluation. Over the duration ofthe 2010 Rating List Fleurets have achieved rates savings over £9m and over 500 successful Business Rates reductions.

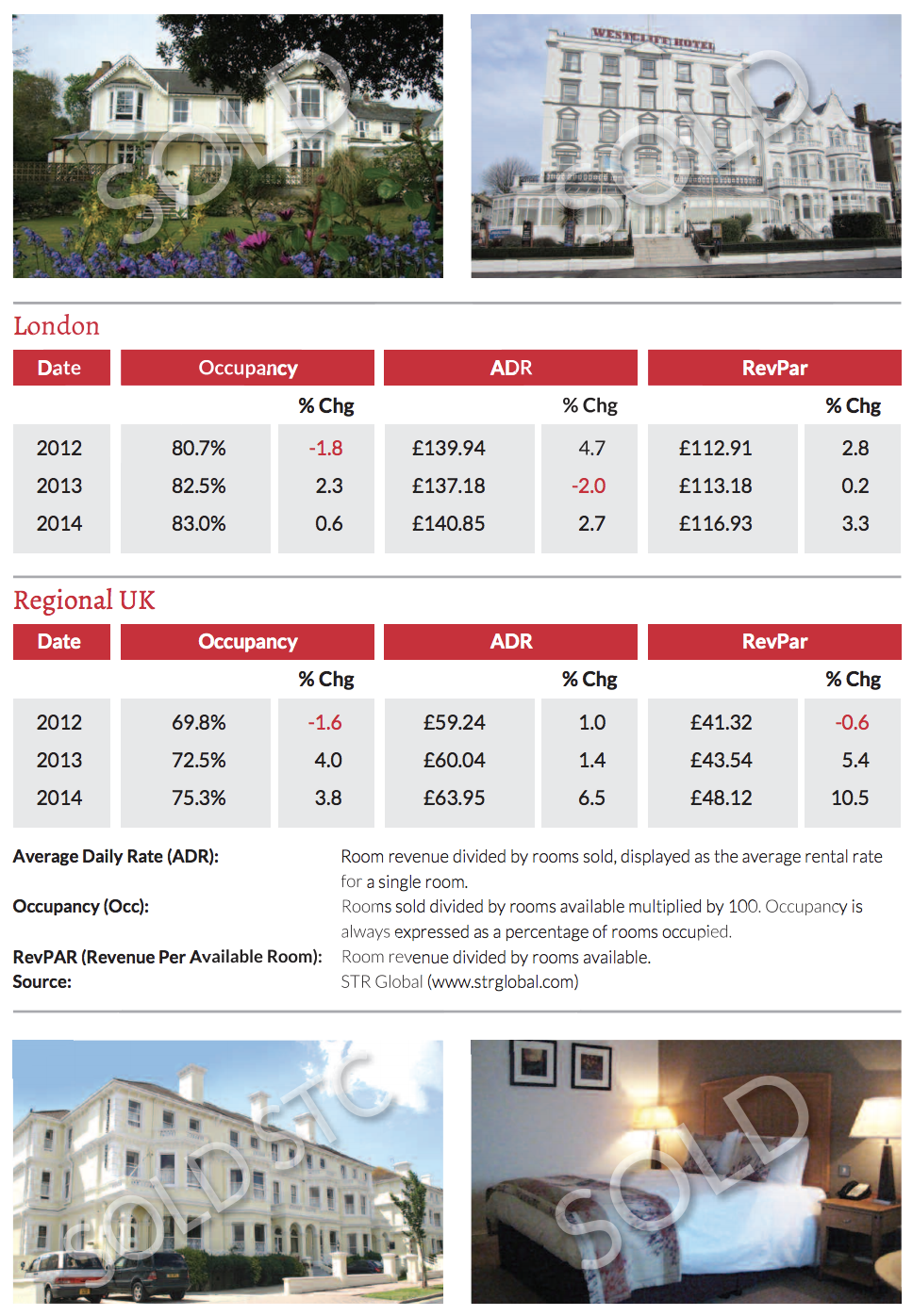

Hotels

Onwards and Upwards

Will Thomas - Associate

Following several difficult years in the hotel sector, it is a delight to see a growing trend of goodnews from operators, owners, investors and lenders, perhaps the most obvious change tobenefit the sector being improving performance.

The table right summarises key hotel performance indices reported by STR Global for hotels in London and across the UK.

Alongside this, the last 12 months has seen the highest volume of corporate transactional activity in the UK for several years. As there are a number of substantial hotel portfolio's presently available in the market attracting keen interest, activity in this arena looks set to continue, at least in the short term.

Improving performance and increased availability of finance, together with the positive messages and improved confidence affecting the sector generally, is driving activity across the full spectrum of hotels, from small guest houses, through to unbranded mid-scale hotels.

With demand for the right hotel stock arguably outstripping supply, in turn applying upward pressure to pricing, the outlook in terms of transactional activity, at least in the short term, is positive.

Restaurants

Oat Cuisine

Graham Campbell - Head of Restaurants

The development of a strong breakfast offer has been a key area of growth for the restaurant market. There has been a strong rise in the popularity of breakfast meetings which are ideal for both formal and informal meetings alike. They have the obvious benefit of being early in the day and have a less disruptive effect on business continuity than a lunch, particularly for those like myself, who can never quite resist the temptation of a cold pint or two. The attendant dangers and temptations around a lunch can often result in many a long, if admittedly enjoyable afternoon, being lost to its delights.

Breakfasts are also more conducive to your health, though the dangers of the full fry are never far from my mind. These days however the options available to the customer are both wide and varied. The continental breakfast with pastries and fruit has long since been an acceptable alternative to the good old English fry up but it is the rise of a once humble Scottish dish which has become a popular and indeed key constituent of the business breakfast.

I am of course talking about one of Scotland's finest culinary exports, porridge. As a proud Scot we have brought many high quality dishes to the international scene, from flat sausage to the delights of the deep fried mars bar. We Scots will fry anything given the option but I recommendthat if you have not tried a deep fried mars bar you are certainly missing out in a culinary treat, particularly when served with vanilla ice cream.

It is delicious and certainly well worth the attendant hardening of the arteries that comes with the eating!

The rise of porridge however has been more meteoric and can be found not only in mainstream restaurants but is now a core element in the breakfast offer of even the major fast food and takeaway brands such as McDonalds and Pret and indeed other more health conscious and middle class brands. Indeed it is now I believe Pret's top selling item.

We have even now reached a point where there is a restaurant, imaginatively titled the 'Porridge Café' which has opened in Shoreditch and is solely devoted to this culinary delight.

How has this happened? In part it is the rise of the health movement. Porridge is a healthy alternative with the oats providing high fibre, slow release, energy to help fuel your working day. Despite its humble primary ingredient, it can be tailored to many differing tastes with the addition of fruit, honey nuts or for the purists perhaps some jam or for the hard core few, salt.

I have to admit as you have probably ascertained from this article to being a bit of a fan. I have tried and tested many bowls of porridge in various restaurants over the years and I have to say that to date the porridge in Bills is as good as I have tried. The hazelnut, fruit and honey combination is unsurpassed.

It is certainly a far cry from the porridge of my youth. My mother was in polite terms an enthusiastic cook but she was never going to win any awards. She used to say that the porridge would stick to your ribs. To be fair she wasn't wrong. In truth it stuck to most things, more often than not the pan it had been boiled to death in! What we could not eat however never went to waste, the remainder my father used to repoint the house!

As a consequence, it took years before I could revisit this proud national dish but thankfully the majority of the many restaurants which I now visit, produce a variety that was unknown to my mother.

As a result I have re embraced its delight and once again can enjoy a pain free tasty bowl of porridge without the attendant threat of a two day bout of indigestion for my pains.

Pubs

Tipping Point - A changing Pub market

David Sutcliffe - Director

The market is turning from one dominated by forced sales to a market where the willing seller once again has a place.

The Public House property market is as diverse as it is complex, but in many parts of the country we have reached the tipping point where the market is turning from one dominated by forced sales to a market where the willing seller once again will dominate.

At Fleurets we have analysed the changing market conditions and now see clear signs that the supply of cheap freehold pubs has declined and demand founded on growing confidence in the economy has increased to a point where many areas of the country have tipped the balance. The long overdue return of the private market, in all its forms, involves many subtle changes to the forces that apply in generating market activity. This change has brought about the return of Fleurets long established No Sale No Fee Agency basis as we herald the return of the private market. The one thing that could undermine the changing pub property market is the impending Market Rent Only (MRO) legislation. If it doesn't come into effect the supply of pubs to the market will reduce and demand will continue to rise. This will be good news for sellers but not so good news for buyers as price rises will follow. If the MRO option does come into effect then the "forced" supply of pub sales will undoubtedly increase once again and values are likely to be held back until the implications are known and the balance is restored.

Leisure

Timing is everything

Graeme Bunn - Director & Head of Professional Services

"A week in politics is a long time" as once commented by Harold Wilson. The events of the last few weeks have however proved that three years is just about the right time for a nightclub operator as Luminar finally completes the assignment of the last of its 42 leasehold interests, three years after being bought out of administration.

The UK's largest nightclub operator, Luminar now operates 59 venues across the UK in Leisure Timing is everything comparison to the heady peak of over 230 venues in 2000 shortly after the acquisition of Northern Leisure. A much slimmer Luminar is however, proving healthier as turnover and sales continue to grow. In contrast, the recently completed CVA by Intertain proved that six years is not long enough, as the company sought to negotiate debt, lease and rent terms with creditors in order to provide "a long term sustainable future" for the company. This has proved successful as debt has been cut from £30m to £14m. Whilst a similar story may well have been painted in 2009 when the then 75 strong Regent Inns entered Administration, only to emerge as 60 site Intertain, it proves that the late night bar and nightclub sector in the UK remains challenging and even strong, good quality management is sometimes not sufficient to reverse declining trading levels in certain locations. How many of the 32 sites have been retained is presently uncertain.

However, as with most aspects of life, as a door closes for someone it opens for someone else. This is proved as Fleurets start to market the former Walkabout in Wolverhampton, both on a freehold and leasehold basis. An impressive Grade II Listed former County Courthouse, the property provides over 9,000 sq ft of accommodation, which was subject to extensive investment by Intertain in 2011. Interested parties should contact Anthony Barnes in Fleurets'Birmingham office, 0121 236 5252, or anthony.barnes@fleurets.com.